Top Tax Return Tips: Save Time and Maximize Your Refund

Posted: February 2, 2021

Updated: February 17, 2025

Time to complete your taxes with confidence! Whether you’re a seasoned tax pro or this is your first year filling taxes, there are always new tips and tricks you can learn to make the process as efficient as possible. Tax season happens every year after all, and keeping up with ever-changing tax laws and rules can feel like a real challenge. Let us help you get ready with everything you need to file your tax returns.

Why Do I Need to File My Taxes?

Starting with the basics, the first step to getting your taxes in order is understanding the why behind it. The reason you need to file taxes every year is to show that you met your responsibility to pay taxes to the U.S. government. Doing this will show the Internal Revenue Service (IRS) how much money you earned in a tax year and how much money you paid in taxes.

Filing a tax return allows you to learn what you owe in taxes, schedule tax payments and request a refund if you have overpaid in taxes over the course of the year. Essentially, filing a tax return provides the IRS with documentation of your expenses, income and how much you are required to pay.

Does Filing Early Benefit Me?

Filing your taxes ahead of time can provide benefits that you may not have thought about before. When tax season starts, you are given ample time to work with a tax professional or to file online. It's up to you on how long you want to prolong the filing process.

If you choose to file as soon as possible you can receive your refund early, gain essential information for large financial changes like buying a house, receive additional time to make tax payments and more.

Essential Information: If you are planning on purchasing a new home or gearing up for college, your tax return information may be invaluable. For college students, your tax return can be used to help apply for financial aid. For a First-time Homebuyer or someone looking to upgrade to a new home, your return can provide proof of household income. All in all, having this essential information can give you a head start on the paperwork.

Quick Refund: The faster you file, the faster you will receive your refund. It can take weeks for a paper version of your filed taxes to process. For a faster return, try e-filing with a direct deposit connected to your bank account.

More Time to Pay: If you end up owing money to the IRS, filing early can be beneficial. You will not have to pay taxes that you owe until the filing deadline if you submit your return in the middle of January. The filing deadline is typically April 15 for individual returns. Having this extra time allows you more freedom to arrange payments on the taxes you owe to the IRS, rather than paying all at once.

Avoid an Extension: Rushing to get your tax return done can add an unnecessary amount of stress. If you push off completing your tax return, there is a much higher chance of human error due to disorganized finances or lack of professional help. Eliminate the need for an extension by filing early.

Fraud Prevention: Filing early can help prevent possible fraudulent tax returns. This is a common fraud attempt that can happen early in the tax season. Someone will try filing under your name with your private information so they can pocket your tax return money. When you submit your return early it can remove the possibility of a fraudster attempting a fraudulent tax return.

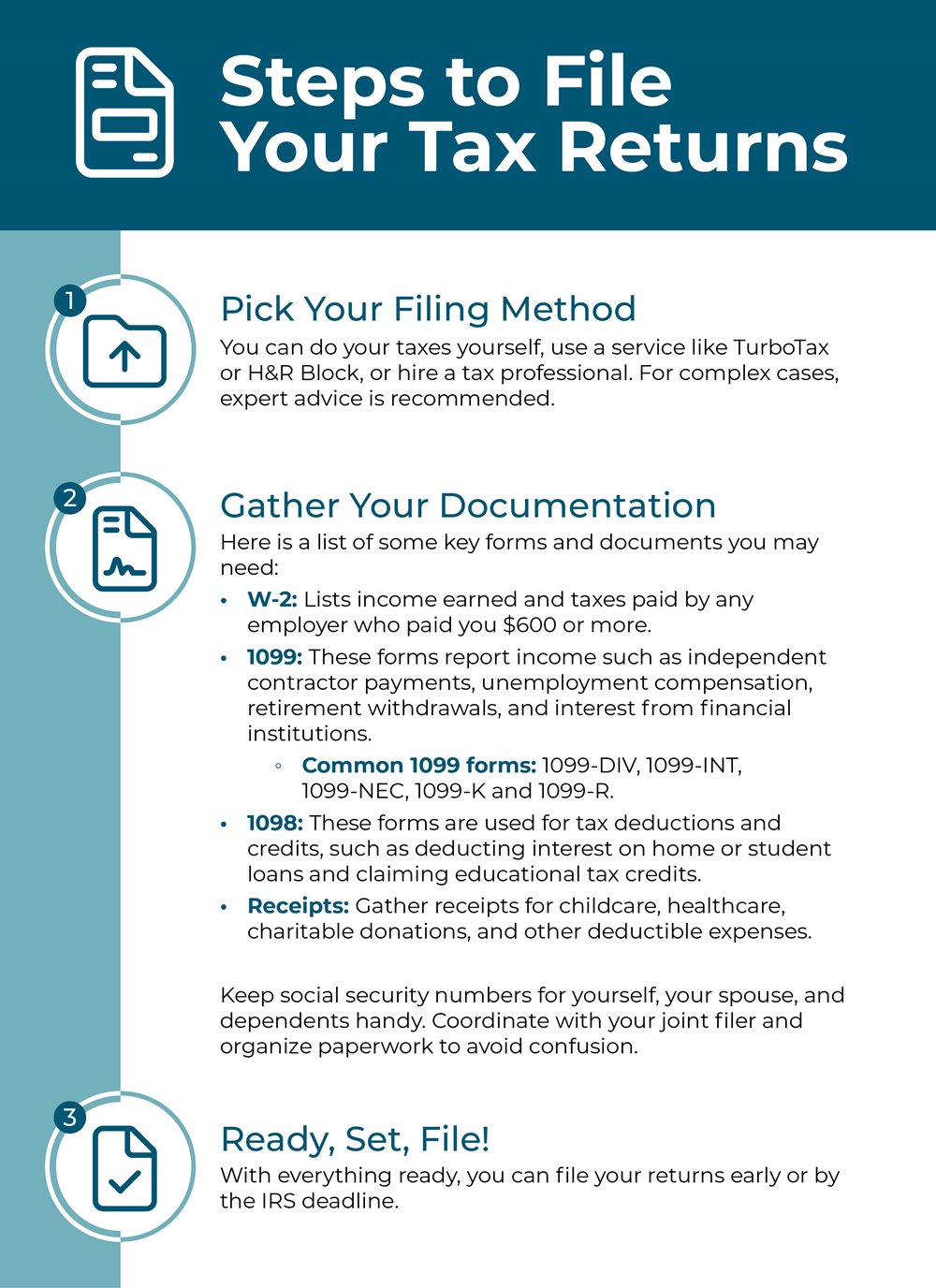

Steps To File Your Tax Return

Step 1: Pick Your Filing Method

You can do your taxes yourself, use a service like TurboTax or H&R Block, or work with an accountant or other tax professional. For more complex situations, you’ll likely want some qualified advice from an expert.

Step 2: Gather Your Documentation

Here is a list of some key forms and documents you may need:

- W-2: You will receive a W-2 that lists the amount of income earned and taxes paid from any employer that paid you $600 or more.

- 1099: These forms cover other types of income including payment as an independent contractor, unemployment compensation, retirement fund withdrawals and interest earned from financial institutions.

- Common 1099 forms: 1099-DIV, 1099-INT, 1099-NEC, 1099-K and 1099-R.

- 1098: These forms are filed for tax deductions and credits. You may use them for deducting interest on home loans or student loans, as well as taking advantage of educational tax credits.

- Receipts: Collect any relevant receipts for childcare, healthcare, charitable donations, etc. that you may want to deduct.

You’ll also need to know personal information such as the social security numbers for yourself, your spouse (if filing jointly) and your dependents. Be sure to keep this information handy when you’re ready to tackle your taxes. If you are no longer filing as an individual, you should coordinate with whomever you are filing jointly with. Getting your paperwork in order beforehand can save a lot of possible confusion down the line.

Step 3: Ready, Set, File!

Now that you’ve rounded up everything you need, you’re ready to complete your returns. Get a head start and file early or file by the IRS tax filing deadline.

Common Mistakes to Avoid When Filing

Filing your tax return is not something that should be rushed. The last thing you want to do after finalizing your return, is make adjustments and file again because of a missed document, math error or an incorrect filing status. Try to avoid these common pitfalls when filing your tax returns.

Too Early – While we stated that filing early as a good thing, double check that you are filing with all your documents. If you don’t wait to file before getting all your proper documents, you risk delays and mistakes.

Inaccurate Information – Double check and reread everything that you enter. There is a lot of detail and steps you need to follow when filling out your tax returns. Mistakes like incorrect Social Security Numbers, misspelled names, inaccurate wages, dividends, bank account numbers or other income received are all too common when rushing the filing process. Keep in mind, when you have problems like incorrect account numbers after submitting, your tax refund will be delayed.

Math. Math. Math. – Probably the most frequent mistake, incorrect calculations from simple addition and subtractions to difficult calculations can cause a lot of problems when filing. The best way to avoid this is by using an e-filing tax software that will do the calculations for you.

Credits and Deductions – Keeping track of everything that you spend and how to deduct it for your tax return throughout the year is no small feat. If you are unsure, determining your tax credits and deductions is best addressed with a tax professional.

If you know ahead of time that filing your taxes may be difficult this year due to big life changes like a new baby, marriage, retirement or the purchase of a new home, try talking with a tax professional. Avoid mistakes with an expert’s advice or at least use an online tax software that will flag any mistakes as you go.

Keep Your Tax Documents Organized

Now that tax season is on its way, having all your proper documents is a must. As a Landmark member, consider enrolling in eDocuments to help. With added convenience and safety benefits, eDocuments make accessing your statements, notices and tax information fast and reliable.

All your statements are available for 24 months and notices and tax forms are available for 13 months. Keep in mind, you can save your documents in case you need them after the 24 or 13-month timeframe.

It also helps to download and keep your tax documents digitally. Create a filing system on your computer so you can easily access all your necessary documentation when filing online. Additionally, you should consider password protecting your files to avoid possible fraud attempts.

FAQs

Q: What are the benefits of filing taxes early?

A: Filing early provides benefits like:

- Receiving your refund early.

- Get essential financial information right away for large financial decisions like buying a house or applying for student aid.

- If you owe money to the IRS, you will have more time to make payments.

- Prevent scammers from attempting to file a tax return with your information.

Q: What documents do I need to file my taxes?

A: To file your taxes, gather your W-2, 1099 forms, 1098 forms, receipts for deductions and personal information like Social Security Numbers for you and your dependents. Be on the lookout for any additional tax forms sent to you if you have additional earning and interest statements.

Q: When is the deadline to file taxes?

A: The tax filing deadline is typically April 15. Remember, filing ahead of time can help you avoid errors and access your refund sooner.

Q: What's the best way to avoid mistakes when filing taxes?

A: Use a tax software like TurboTax or H&R Block to file online. Online software will flag when a mistake has been made while filing. Additionally, you could consult a tax professional to help avoid common errors like incorrect calculations and missing documents.

Time to Get Started

We know filing taxes can be tough at times, but we hope you found these tips helpful! Create an action plan by figuring out your deadlines, learning to how to file properly and making sure you have all your documents in order. Think about getting help from a tax professional or using tax software. This can help you avoid mistakes and get the most from your returns.