Strategies That May Help Maximize Your Retirement Money

Posted: September 27, 2024

Updated: September 27, 2024

Creating a roadmap to spend retirement money is an efficient way to prepare for expenses throughout retirement. Planning is important for managing money, preparing for taxes, and aiming to preserve retirement savings. Use these steps to craft a smart spend-down plan, in an effort to make your investments last through your golden years.

Assess Your Future Needs

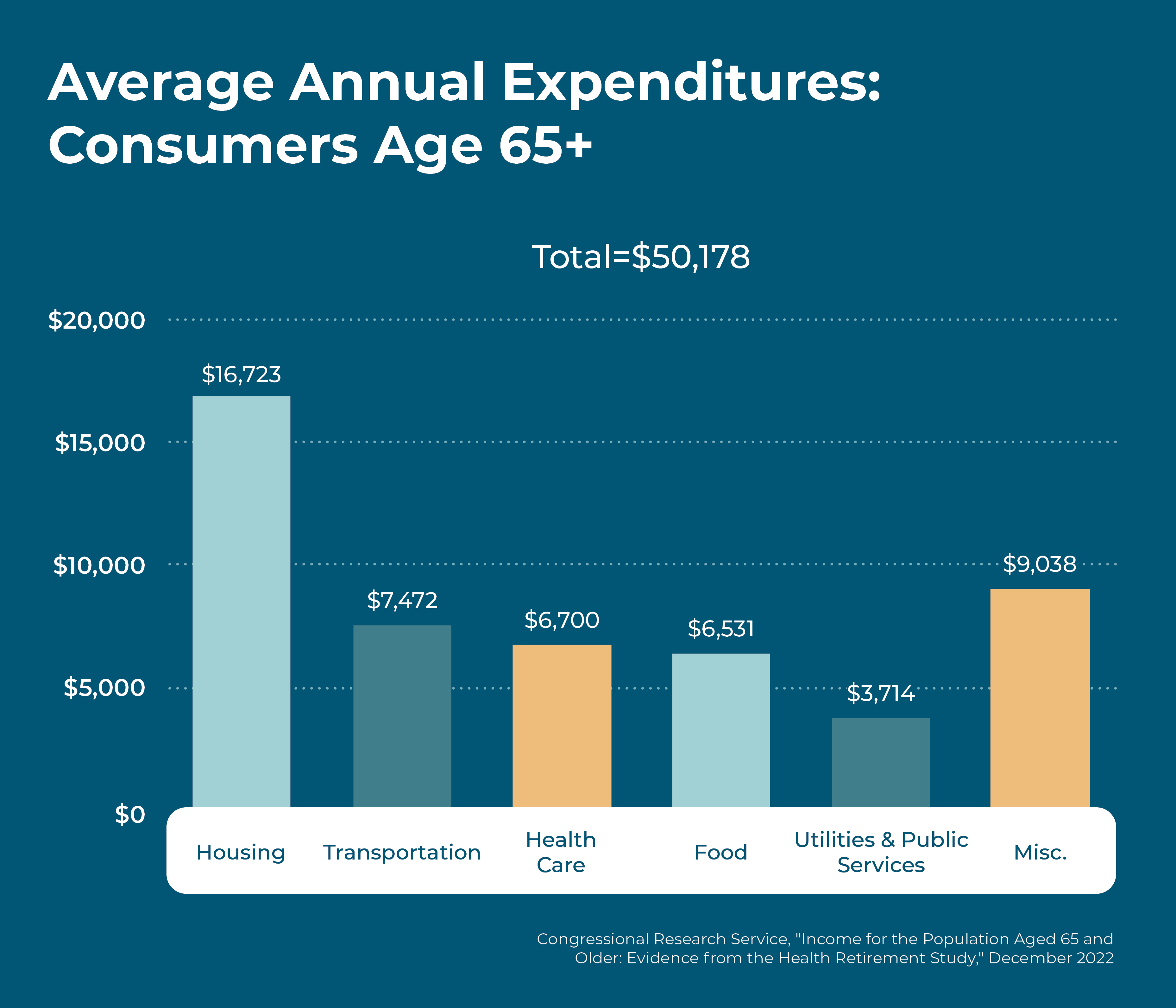

The first step in creating a retirement savings spend-down plan is to evaluate your post-career needs. Consider your expected expenses, including housing, healthcare, travel, and other spending. Think about care costs and inflation when striving to ensure your savings will last. Get a clear understanding of your financial goals and lifestyle expectations.

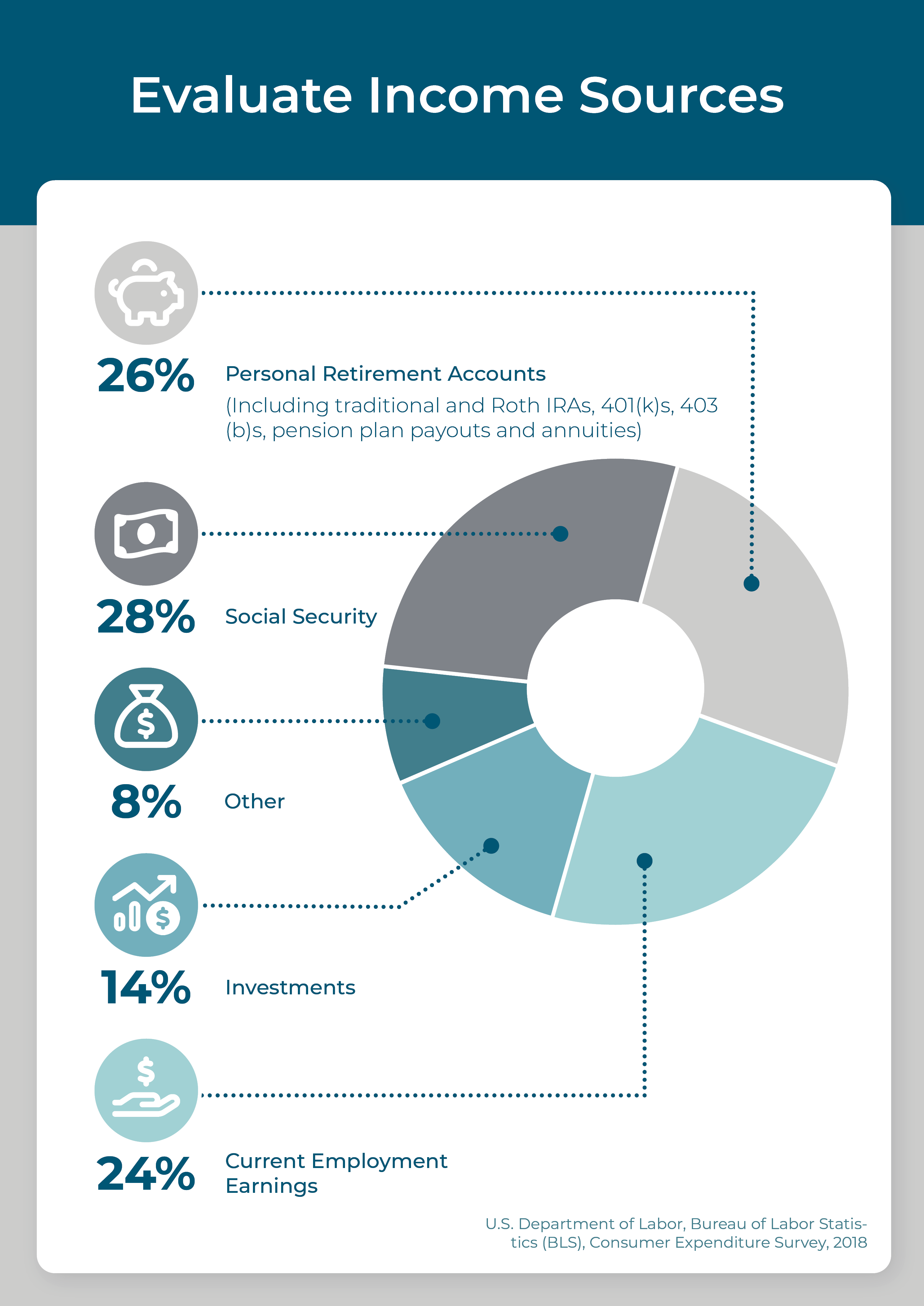

Evaluate Income Sources

Next, evaluate your potential sources of retirement income. These may include:

- Social Security benefits

- Pensions

- Part-time work

- Other investments

Estimate how much income you can expect from these sources. This will help you decide how much you'll need to rely on your savings to meet your income needs. A comprehensive view of all your potential income streams is crucial to create a realistic spend-down plan.

Create a Realistic Budget

Once you clearly understand your needs and potential income sources, it's time to create a realistic budget. Planning your retirement income for expenses helps you understand how much you can spend each year as you grow older and use your savings. Include cost of living items such as housing, utilities, food, insurance, transportation, and other spending. Remember to factor in travel and leisure activities.

Diversify Your Savings Portfolio

Diversifying your investment portfolio is vital to managing risk, returns, and pursuing a steady income stream throughout retirement. Consider a mix of stocks, bonds, and other income-generating investments to balance risk and return. Occasionally rebalancing your portfolio may help maintain your strategies and align with your retirement income needs and risk tolerance.*

Implement a Withdrawal Strategy

Implement a systematic withdrawal strategy. This strategy involves simultaneously withdrawing money from your retirement accounts to create income while monitoring taxes. Financial consultants can help determine how much money to withdraw, when, and from what type of account — tax-deferred, taxable, or tax-free.

Consider Taxes

Taxes play a significant role in retirement. The type of retirement account will have unique tax implications for withdrawals.

- Traditional IRAs - You contribute pre-tax money. The contribution and accumulation are taxable as ordinary income in the year of withdrawing the money.

- Roth IRAs - You contribute after-tax money. Both the initial investment and accumulation are tax-free when withdrawn. A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

- Taxable Accounts - You make contributions with after-tax money. You pay taxes on interest, dividends, and capital gains in the year earned. Checking, savings, money market, and brokerage accounts are all examples of taxable accounts. Taxable accounts have none of the special tax rules that tax-advantaged accounts have.

Understanding the tax consequences of your withdrawal decisions can help mitigate your tax burden while seeking to optimize your retirement income. Working with financial and tax professionals can provide valuable insights. They can help you assess how withdrawing money from your retirement savings portfolio will impact your taxes.

Monitor and Adjust Your Plan

Creating a spend-down plan is not a one-time task; it requires ongoing monitoring and adjustment. Regularly reviewing your expenses, income, and investment performance is vital. Life events, market fluctuations, and changing financial needs may necessitate updates to your plan. Flexibility is essential to maintaining a sustainable approach as you spend your retirement savings.

Retirement Savings Concerns

Often, pre-retirees have two specific concerns. They wonder how much money they can withdraw from their accounts before they run out and how much to keep in the market. "How much money can I withdraw before I run out?"

When determining how much to withdraw each year, you must consider your age, life expectancy, investment returns, and inflation. Secondary factors to consider include whether you have a partner, where you will live, the cost of healthcare and long-term care needs.

Some financial professionals recommend the 4% rule. With this strategy, you withdraw 4% of your retirement savings in the first year of retirement. Then, you adjust the following withdrawals for inflation.

However, individual circumstances may warrant a more personalized approach. Consulting with a financial consultant can help you work toward establishing a withdrawal strategy tailored to your unique situation.

"How much of my money should I keep in the market?"

Many pre-retirees and retirees are concerned about the stock market's impact on their retirement savings. How much you keep in the market depends on your risk tolerance, retirement portfolio holdings, and personal situation. However, it's important to factor in taxes and inflation, life expectancy, debt and your living situation.

Financial professionals have software that can mimic market performance scenarios and their impact on retirement savings. Although, past performance does not guarantee future results, and investing comes with risk.

Work with a financial consultant to design a retirement income portfolio that allows growth potential while minimizing stock market exposure. They might recommend other investment strategies. For example, bonds or real estate investment trusts (REITs) or insurance products, such as fixed-indexed annuities.

The Bottom Line

Ultimately, saving for retirement is critical during working years. And post-career, the more your focus will shift toward spending down assets and maintaining financial independence.

Assess your needs and income, create a realistic budget, diversify your investment portfolio, implement a withdrawal strategy, consider tax implications, and monitor your plan. Careful planning will set you up for a confident retirement.

Want custom guidance on preparing to spend down your retirement savings? Meet with a Landmark Investment Center financial consultant to design a plan for your individual situation.

*There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Landmark Credit Union ("Financial Institution") provides referrals to financial professionals of LPL Financial LLC pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Landmark Credit Union and Landmark Investment Center are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Landmark Investment Center, and may also be employees of Landmark Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Landmark Credit Union or Landmark Investment Center. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Landmark Credit Union Guaranteed | Not Landmark Credit Union Deposits or Obligations | May Lose Value |