Overcoming Market Uncertainty: Financial Strategies for Retirement Savers

Posted: December 18, 2024

Updated: December 18, 2024

Market uncertainty occurs when investors find it challenging to analyze current and future market conditions due to market volatility. Factors such as inflation, central bank policy changes, interest rate fluctuation, investor behavior, unemployment news, and industry buzz can cause market volatility.

If an unpredictable economy is making you feel anxious as you’re preparing and saving for retirement, you aren’t alone. Learning how to manage your finances during turbulent times may help alleviate the stress and uncertainty you feel as you work to preserve and grow your hard-earned wealth.

How can I keep up with inflation in retirement?

Inflation is generally a large-scale measurement of prices over a given period of time, such as the increase in cost of living nationwide, or the overall increase in prices. For many investors, inflation is a concern because as companies watch their costs rise, and the price of materials they need to produce products increase, producing goods and services becomes more expensive. This causes profits to fall, lowering stock prices.

Fortunately, several strategies may help you keep up with inflation. Consider these suggestions:

- Hold onto your stocks – It’s true that inflation can be a downside for growth stocks because companies during periods of inflation have to spend more to produce their products, which drives down stock prices. However, over the long term, stocks have been able to outpace inflation. Value investors are less concerned about inflation.

- Don’t hoard your cash – You should consider saving up enough cash to cover expenses and unexpected emergencies for up to 3 to 6 months. Everyone is different, so the amount you would have to save varies from person to person, or family to family. However, you don’t want to hoard all of your cash for fear that the market might crash at any point. The problem with hoarding your cash is when inflation rises, your return on the cash you have will be lower.

Instead, consider investing the excess cash you saved after compiling an emergency fund into low-risk investment opportunities such as money markets, treasury bills, certificates of deposit, high-yield savings accounts, index funds, or mutual funds. A financial consultant can help you figure out a beneficial approach for your strategy. -

Inflation-protected bonds – As you near retirement, you may be considering revising your portfolio toward holding more fixed-income investments, like inflation-protected bonds. For example, Treasury Inflation-Protected Securities (TIPS) help to mitigate the effects of inflation by adjusting the principal for inflation and deflation. The TIPS goes up with inflation and down with deflation.

When the TIPS matures, you receive either the increased (inflation-adjusted) price or the original principal, whichever is greater. There is virtually zero risk that you will ever get less than the original principal. The biggest downside is that you could have made more money elsewhere.

-

Four percent rule – Spend less to save more. If you are nearing retirement or already retired and concerned about preserving your money throughout your retirement, the four percent rule is a popular approach used by retirees looking to manage their spending to stretch their savings.

The idea is that you shouldn’t withdraw more than 4% of your retirement account per year. Some financial analysts suggest this is even too much. However, a financial consultant can help you create a budget that aligns with your financial goals.

How can I receive consistent income during uncertain economic conditions?

-

Value investing – Being a value investor focused on stocks that offer dividends could help to provide a consistent income over time as your dividend payments increase. There are investors whose financial strategy is to live off their dividends, thus having an income stream without touching the investment principal. As a friendly reminder, dividend payments are not guaranteed and could be reduced or stopped at any time by the company.(147-LPL)

-

Bond laddering – Involves investing in bonds with different maturity dates to help mitigate interest rate risk. When a bond matures, you reinvest the principal in new bonds with the longest term you originally chose for your ladder. You can reinvest at higher rates as interest rates increase.

- Diversification – A diversified investment approach may help to mitigate some of the risks associated with interest rate changes, market fluctuations, and erratic market conditions. Keep in mind, there’s no guarantee that a diversified portfolio will boost overall returns or outperform one that isn’t diversified. While diversification can help manage risk, it doesn’t eliminate market risk entirely. (26-LPL)

What do I do if my retirement account is in the bank and the government cuts interest rates?

A Federal Reserve rate cut may be welcomed news from some borrowers, but this might not settle well with others, particularly retirees. As rates decrease, yields on savings accounts, fixed annuities, and certificates of deposit do as well. They also squeeze pensions and long-term care plans.

Long-term care plans are impacted because a portion of the cost of long-term care insurance is generally covered through yields on investments. Low interest rates tend to squeeze those returns. Insurers will then be forced to hike premiums that may have already been increased. Pensions generally are invested in mostly fixed-income investments, which depend on higher interest rates and increased stock returns.

Consider consulting an investment professional.

Ready to take control of your financial future? Meet with a Landmark Investment Center financial consultant, and make your retirement investments work harder for you.

Important Disclosures:

This article was prepared by LPL Marketing Solutions

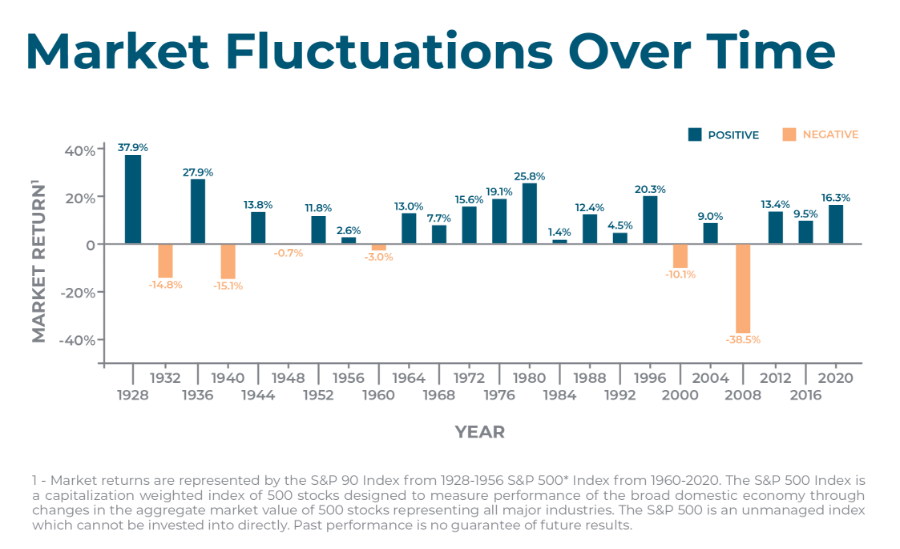

1 - Market returns are represented by the S&P 90 Index from 1928-1956 S&P 500* Index from 1960-2020. The S&P 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The S&P 500 is an unmanaged index which cannot be invested into directly. Past performance is no guarantee of future results.

All investing involves risks, including the loss of principal.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Landmark Credit Union ("Financial Institution") provides referrals to financial professionals of LPL Financial LLC pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Landmark Credit Union and Landmark Investment Center are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Landmark Investment Center, and may also be employees of Landmark Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Landmark Credit Union or Landmark Investment Center. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Landmark Credit Union Guaranteed | Not Landmark Credit Union Deposits or Obligations | May Lose Value |