Do I Need Life Insurance in Retirement?

Posted: April 9, 2025

Updated: April 9, 2025

You work your whole life hoping to retire when you want. You might dream of having more free time for social activities, travel and hobbies. Perhaps you couldn’t do them as often as you would have liked because of your job and family responsibilities. Even though the daily grind will come to an end, managing your finances won’t. A question people often ask their financial consultant is, “Do I need life insurance in retirement?”

What is Life Insurance?

Life insurance is a contract that pays a sum of money to your beneficiaries after you die. It is also used to add to other income in retirement. This includes pensions or Social Security. It can help cover bills if you have debts, living costs, education or burial expenses.

It’s not just the benefits a policy offers that can factor into your decision to pursue one policy against another but also the price; this varies significantly with age, health and the type of insurance you choose.

Why is Life Insurance Useful in Retirement?

For many individuals, life insurance can be a critical part of their retirement portfolio and financial strategy. Everyone’s circumstances are unique to their life events, experiences and expectations. Several of the reasons why life insurance could be beneficial for a retiree include:

- Provide a Tax-Free Inheritance: Many people associate life insurance with leaving money to their beneficiaries. What people might not know is that it is tax-free and can help a family financially stay afloat, should you pass away.

- Covering Financial Expenses: One thing we all have in life is expenses and they can be steep. Life insurance can help pay for medical bills, estate taxes and funeral costs.

- Providing for Loved Ones: Life insurance can help support your family financially if you pass away.

- Pay Down Outstanding Debt: Life insurance can help pay down mortgages, credit card bills, car loans and other forms of debt.

Is It Possible to Buy Life Insurance Through a Qualified Retirement Plan Such as a 401(k) or Pension?

Yes, it is possible to purchase life insurance through a qualified retirement plan. By doing so, you can pay for the coverage using pre-tax dollars. This can be very complex, and it’s best to speak with a financial consultant . If your plan is terminated early or you retire, the remaining balance can be rolled over into an IRA.

A downside to this strategy is that it involves complex regulatory requirements and can be costly.

What Types of Life Insurance are Available?

There are three main types of life insurance: whole life insurance, term life insurance and universal life insurance . Although there are many different types of life insurance such as final expense, credit life, decreasing term life and mortgage life, we will focus on the three most common ones. Each type offers benefits that match different financial and retirement goals.

Every individual and family has unique wants and needs. Let’s dig a little deeper into the three main types of life insurance.

1. Whole Life Insurance

Also called "Cash Value Live Insurance, whole life insurance is considered the most secure form of insurance. It’s a permanent life insurance that offers guaranteed premiums, a guaranteed death benefit and a cash value option that grows. Also, interest accrues on a tax-deferred basis and some policies may earn dividends based on the company’s performance. If you pass away, your loved ones will receive a tax-free gift, and these policies, in many cases, have “living benefits” that can be helpful if you experience health problems as you age.

How Do They Determine the Cost of Whole Life Insurance?

- Amount of Coverage You Have: The larger the death benefit payout, the higher the premiums.

- Age: Younger buyers generally pay lower premiums, so it’s advantageous to buy whole life insurance earlier.

- Health: If you suffer from a pre-existing condition like diabetes or another medical condition or practice certain habits like smoking, your premiums could be higher.

- Policy Length: The longer your coverage period lasts, the higher your rates will be.

- Sex: Men may pay more than women because they have a lower life expectancy.

- Career Choice: Riskier jobs such as logging, being an iron or steel worker, construction or being an aircraft pilot, to name a few, may increase your rate.

- Hobbies: People who participate in risky hobbies like mountain climbing or base jumping may have higher premiums.

- Type of Policy: Whole life insurance is more expensive than universal life insurance and term life insurance.

The Pros and Cons of Whole Life Insurance

Pros

-

Cash Value Growth: The cash value grows at a set rate each year at a guaranteed rate of return. The growth is tax-deferred.

-

Guaranteed Cash Value: The cash value is guaranteed to grow, tax-deferred and isn’t impacted by market volatility.

-

The Upside to Keeping it in an Irrevocable Trust: The benefit of using an irrevocable trust is clear. Trust tax rates can be high, just like estate tax rates. This makes putting a whole life insurance policy into an irrevocable trust (ILIT) a smart way to pass on wealth to your loved ones. With the current high tax exemption, few people run into federal estate tax problems but using the tax efficiency and simplicity of the policy once put into a trust is a plus.

-

Fixed Premiums: The amount you pay each month or year is set for the life of the policy.

-

Can Borrow Money Against Your Policy: As long as the policy isn’t a Modified Endowment Contract, you can access your death benefit and borrow against it. Keep in mind when you pass, the total you borrowed is subtracted from the death benefit that is paid to your beneficiaries.

-

Tax-Free Death Benefit: Your death benefit is paid to your heirs tax-free.

Cons

- Flexibility: There is limited flexibility. Premiums and death benefits can’t be changed, so you will want to review your decisions carefully.

- Higher Rates for Older Policyholders: Premiums are typically higher than other types of life insurance.

- Low Returns: A major downside is that a good whole life insurance policy gives returns of only 1% to 3.5%. This return falls far lower than the 8% to 10% return that investors can expect from the stock market.

- Withdrawals and Loans May Affect the Benefits of Your Policy: Taking a loan or withdrawal against your policy may decrease or even eliminate the death benefit for your beneficiaries depending on how much you take. If the contract terminates with outstanding debt, you could be subject to an income tax liability. The cash surrender value could potentially lead to your policy lapsing. The cash surrender value is the amount of cash you have built less any surrender charges or fees.

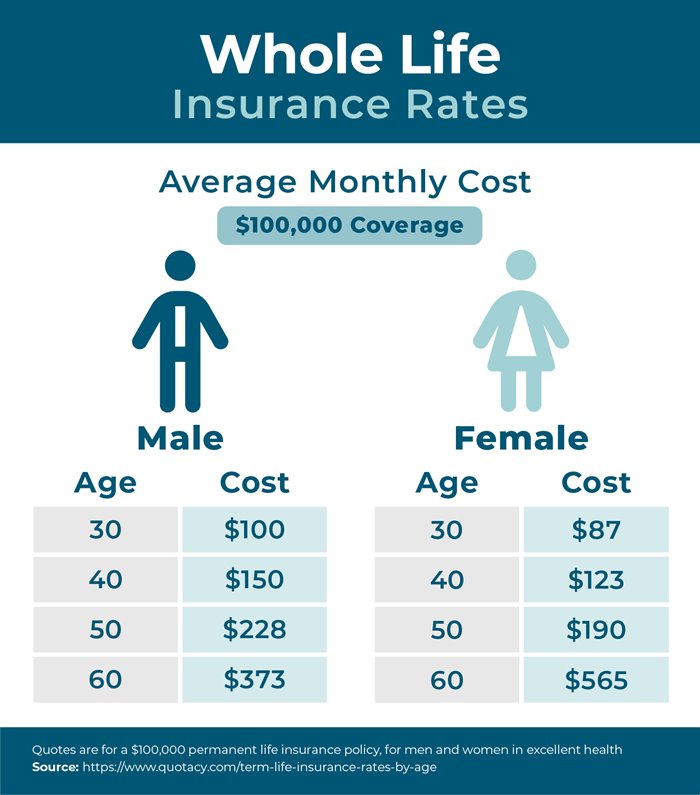

Whole Life Insurance Rates

| $100,000 Coverage | Average Monthly Cost, Male | Average Monthly Cost, Female |

|---|---|---|

| 30 | $100 | $87 |

| 40 | $150 | $123 |

| 50 | $228 | $190 |

| 60 | $373 | $565 |

Source: Quotacy

2. Universal Life Insurance Universal

Life Insurance is a type of permanent life insurance designed to provide coverage for the duration of your life. You can adjust your premiums and death benefit as your life events change offering a certain flexibility. There is also a savings component or investment function that can help your money grow over time. However, if a policyholder needs access to the money, they will have to pay taxes on the withdrawals.

The Types of Universal Life Insurance

- Guaranteed Universal: A permanent life insurance policy that has fixed premiums and a guaranteed death benefit, based on the claims-paying ability of the issuing insurance company.

- Variable: A permanent life insurance policy that has a savings component where cash value can be invested.

- Indexed: A type of universal life where the cash value grows based on the stock market index.

How Do They Determine the Cost of Universal Life Insurance?

- Amount of Your Death Benefit: The greater your death benefit, the higher the premium.

- Age: Generally, the younger you are, the less expensive your life insurance policy will be. The older you get, the greater the likelihood of dying becomes and therefore the cost increases. So, the sooner you get your policy, the cheaper it should be.

- Health: If you are in poor health, you may face higher premiums because of the risk of an earlier death.

- Interest Rate: The interest rate applied to the cash value component may increase the cost of the policy.

- Policy Features: Adding additional riders or other special benefits may increase the cost of your premium.

The Pros and Cons of Universal Life Insurance:

Pros

- Premiums are Flexible: Universal life insurance lets you change your payments when life events occur. However, there are limits to this flexibility.

- Cash Value Option: The flexible savings part of the universal policy can grow over time. This growth is based on some of your premium payments that are not used for insurance costs. It can grow with interest and, depending on terms, can be used for withdrawals or loans.

- Death Benefits are Adjustable: You can adjust your death benefits. If you pass a medical exam, you can increase your death benefit. However, you will need to pay a higher premium. Conversely, you can decrease your death benefit to lower the cost of your premium.

- Loans Against Your Policy are Permitted: Loans are only available on policies that have a cash value component.

Cons

- Making Minimum Payments or Missing Payments Altogether Can Negatively Impact Your Cash Value: Premium payments may increase if you skip or make minimum payments.

- Certain Withdrawals May Be Taxed: If you withdraw any gains on your policy (like dividends) these amounts may be taxed as ordinary income.

- Fixed Premium Payment is Not Guaranteed: Many people see a fixed premium as a safeguard which universal life insurance does not offer.

- No Guarantee of Any Return: There is no guarantee that your investment will generate a return due to market unpredictability.

3) Term Life Insurance

Term life insurance is typically the most affordable life insurance option. Generally, you purchase the life insurance to last a period of time, usually 10, 20 or 30 years. With term life insurance your premium will stay the same throughout those years.

This policy guarantees that your beneficiaries will receive the death benefit. This benefit is paid at the policy’s face value and is usually not taxable. The cash benefit may be used to settle debt, funeral costs, health care and other expenses. However, there is no requirement that beneficiaries use the insurance proceeds to settle the deceased’s debts.

If the policy expires before your death or you live beyond the policy term, there is no payout. You can renew the policy when it expires. However, the insurance company may change the premium based on your age at that time.

How Do They Determine the Cost of Term Life Insurance?

- Amount of Coverage You Have: The greater the coverage amount, the more it is going to cost.

- Age: Generally, the younger you are, the less expensive your life insurance policy will be. The older you get the greater the likelihood of dying becomes therefore the cost increases. So, the sooner you get your policy, the cheaper it should be.

- Health: Your health is a critical component to determining what you could pay for a policy. If you are a smoker, for example, your policy will probably cost you more because of the risk factors of smoking. Quitting smoking can potentially help you get a better rate. If you suffer from a pre-existing condition like diabetes or another medical condition, you also may have higher premiums.

- Policy Length: The longer your coverage period lasts, the higher your rates will be.

- Sex: Women usually pay less for life insurance than their male counterparts (on average 24% less) because women tend to outlive men.

- Career Choice: If you work in a high-risk job, such as a logger, iron or steel worker or aircraft pilot, it may help to drive your rate higher.

The Pros and Cons of Term Life Insurance:

Pros

- Affordability: It’s a less expensive option than permanent life insurance. Younger people, particularly young parents find term life insurance appealing for the decent coverage at a lower cost. Premiums are lower the earlier you purchase a policy and if you purchase online, you may also get a lower rate. If the insured person dies while the policy is active, the family can use the death benefit. This money can help replace lost income.

- Flexibility: You get to decide the length of your coverage. When your coverage ends, you may have the option to end or continue your coverage without a medical exam. You have the option to lower your death benefit over time, which can reduce your premium.

- Tax-Free Payout: Death benefits are typically paid out tax-free to your beneficiaries.

- Additional Riders: You can add riders to your policy, for example, critical illness coverage or accidental death benefit which adds another layer of safeguarding.

Cons

- No Cash Value: Unlike permanent life insurance, term insurance doesn’t allow you to accumulate cash value.

- Coverage Ends: You won’t receive the benefits if you outlive the term of your policy.

- Cost of Renewal: Generally, if you renew your policy, it will be recalculated and you could pay a higher premium based on factors like age and health.

- Limited Flexibility: Term life insurance doesn’t offer the same variety of options to adjust coverage as permanent life insurance.

- No Return on Premiums: If you outlive the term, unlike many permanent policies, standard term life insurance don’t return premiums. A surrender charge is a fee imposed by the insurance company when the policyholder cancels their life insurance policy before the maturity date.

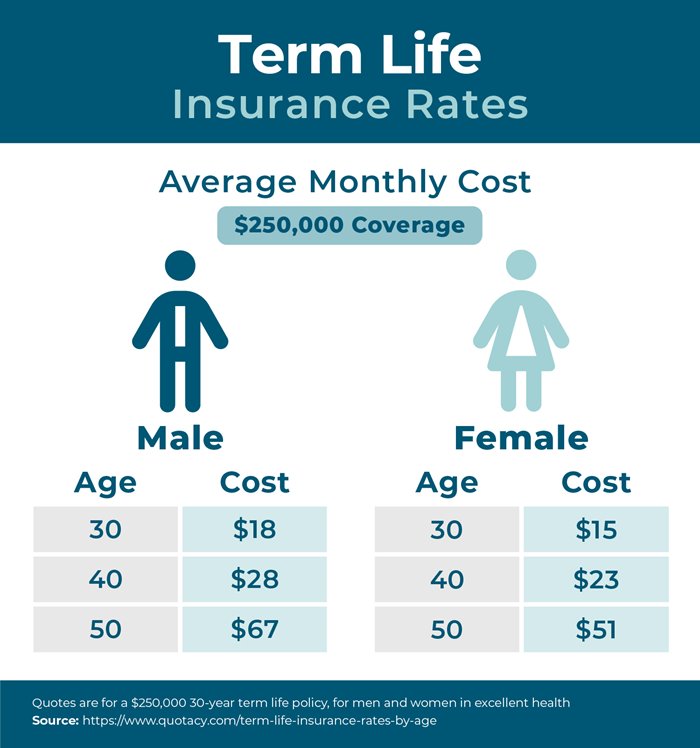

| $250,000 Coverage | Average Monthly Cost, Male | Average Monthly Cost, Female |

|---|---|---|

| 30 years old | $18 | $15 |

| 40 years old | $28 | $23 |

| 50 years old | $67 | $51 |

Quotes are for a $250,000 30-year term life policy, for men and women in excellent health.

Source: Quotacy

Schedule a Meeting With Your Financial Consultant

Choosing a life insurance policy that fits your financial and retirement goals can be a tough decision. There are many options and scenarios to consider. It’s important to talk to your financial consultant about your questions and concerns. They can help you find what is best for you and your family now and in the future.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Landmark Credit Union ("Financial Institution") provides referrals to financial professionals of LPL Financial LLC pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Landmark Credit Union and Landmark Investment Center are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Landmark Investment Center, and may also be employees of Landmark Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Landmark Credit Union or Landmark Investment Center. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Landmark Credit Union Guaranteed | Not Landmark Credit Union Deposits or Obligations | May Lose Value |