Let’s Break it Down

It’s time to use your financial knowledge to finalize your goals. Whether it’s additional ways to save, paying off debts, or managing your credit score we’ve got you covered. Understanding your finances takes time, but reaching the finish line with all your ducks in a row can be a great feeling!

Use our resources as stepping stones to continue building confidence in your financial future.

-

Savings Accounts:

Build your savings with competitive rates and great returns. Check out our certificates and money markets.Learn More -

Maintaining Better Credit:

Explore ways to manage your credit score and ensure that it stays in proper standing.Learn More -

Refinancing or Downsizing:

Ready to refinance or downsize? Discuss your options with one of our experienced loan officers.Learn More -

Budgeting and Debts:

Find a budget that works for you and prevent a future headache with proper debt planning.Learn More

Plan Smart. Travel Better.

Vacation memories shouldn’t come with financial stress. Here’s how to make smart preparations, stay on budget and get the most value from your getaway.

Plan, plan and plan some more! One of the best ways to avoid unnecessary expenses on vacation is to plan ahead. Putting in the effort to research the specifics of your vacation spot can help get the most out of your days without having to worry about last-minute expenses or unforeseen situations. Address the following before booking your next trip.

- Best time to visit

- Local weather

- Travel insurance

- Transportation options

- Local customs

While we encourage you to take a load off once you arrive at your destination, keep a budget in the back of your mind. If you can, try to stick to a daily budget so you don’t overspend or impulse buy. The last thing you want to do is to use up all the money you saved in one day.

What’s better, packing the car for a family road trip or soaring through the sky to your destination? Whatever you choose, make sure you consider the possible costs. Buying a plane ticket may look like a big expense, but a 20-hour drive may end up costing more. When you add up the cost of gas, snacks, tolls and a possible overnight stay, you may end up spending more on the road than on a flight ticket. Try a few of these road trip tips to save you money:

- Calculate mileage to manage the cost of gas

- Prep snacks and meals before leaving

- Swap drivers to skip hotels

- Put money on an E-pass or pay tolls online to avoid toll lines

- Do some car maintenance before leaving

The two biggest costs when it comes to vacations are usually flights and hotel stays. Knowing the best time to book a flight or hotels is just as important as shopping for the best price. There are plenty of sites, apps or articles out there that can help you save money on flights or hotel prices. To get you started, here are a few common tips to help you save in the long run.

Hotel Saving Tips

- Book with a hotel directly instead of a discount site

- Steer clear of peak days like Fridays for check-in or Sundays for check out

- Booking stays on Monday and Tuesday are often cheaper

- Booking the day before, for short trips often has reduced prices

- Use the rewards points you get from a Landmark Rewards Credit Card

Flight Saving Tips

- Departing Monday, Tuesday or Wednesdays are usually cheaper than weekends

- Flights with layovers can be as much as 20% cheaper

- Consider multiple airports when searching

- Use a price tracker

Boost Your Home’s Value

Make your home worth more by making it work for you! Looking for ways to boost your curb appeal? Whether you are renovating your kitchen, replacing your siding or building a new deck, a HELOC is the right choice for all your projects. Check out our recent article on everything you need to know about adding value to your home!

Learn about:

- Project budgeting tips

- Funding strategies

- Aesthetic upgrades that pay off

- High-impact renovation ideas

30 Days to Financial Wellness Calendar

Keeping your finances top of mind is much easier with a daily tracker! Get a free copy of our 30-day savings and wellness calendar. Plus, we’ve recently updated our calendar with tips and tricks directly from our members!

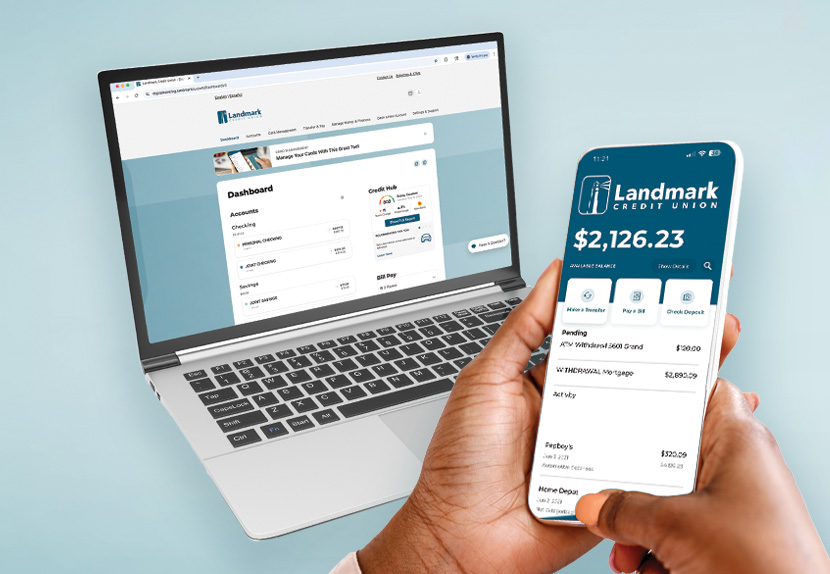

Manage Your Money From Anywhere

Your banking experience should feel safe and convenient. Digital Banking gives you secure, around the clock access to your money. Our online platform is loaded with convenient budgeting features, a personalized interface, expense tracking and enhanced safety features for all your banking needs.

Start managing your money anytime, anywhere with Digital Banking or download our mobile app, for 24/7 banking in the palm of your hand.

Using Credit Cards Wisely

A credit card is a great tool to have for your financial needs. They can be used to build your credit score, for travel benefits and more. Just be cautious if you are using one for all your expenses.

It’s easy to create a pile of debt with credit card purchases, interest and fees. Learning to use your credit card responsibly is an important skill so you don’t end up with debt you can’t afford to pay back. Lookout for the following pitfalls when using your credit cards.

-

If you use your card for everyday spending, you can use features like auto pay to make sure you never miss a payment. When you pay your balance in full each month you can maximize the benefits and protections that come along with your credit card. Keep in mind, missing payments can negatively affect your credit score.

-

Live within your means and purchase what you can afford. Be smart about your spending habits, and never spend up to your limit. Just because you have access to more money, does not mean you should use all of it. If you have trouble overspending, you can add spending limits using our card management tool in Digital Banking.

-

Experts suggest that you should use less than 30% of your credit. Going over that limit can incur higher fees and quickly prevent you from paying down debts.

-

Set up alerts to monitor fraud. Always keep an eye on your transactions for phony purchases. If you notice charges like these, notify your card company and put a hold on your account. Landmark members can easily monitor transactions like these or put their card on hold by using our mobile app.

-

Understand fees and how interest will be charged to your card. Annual fees and late payment fees can add up without you realizing. Get ahead of this by managing your monthly payments.

What Does Your Savings Look Like?

Diversify your savings options for the long haul and complement your goals. Don’t keep your money under the mattress, put it into a savings account that grows over time! Take advantage of one or more of our savings options and make your money work for you.

Further Your Financial Knowledge

Introducing our new learning center! Add another building block to your financial brain power with helpful concepts, tips and tricks.

We’ve pulled together a comprehensive list of educational articles, courses and guides all in one convenient place tailored for you. These guides can help you deal with healthcare costs, investment risks, taking control of lingering debts and so much more. Exercise your mind with our free courses now!

Stay on Top of Your Credit Score

Do you know your credit score? If it’s not where you hoped it would be or if you want to make sure it doesn’t change, use Credit Hub to stay on track. Sign up in Digital Banking to check your score for free, set up alerts, set credit goals and learn how to maintain your score.1

5 Tips to Maintain Better Credit

- Pay your bills on time each month: Remember, late payments can affect your score.

- Pay down debt as soon as possible: Avoid using more than 30% of the credit available to you.

- Hang onto old card accounts: The longer a credit line stays open, the more positive it looks.

- Don’t over-apply for new credit: Every application for a card or loan requires a credit check that can ding your score.

- Spread your debts around: Having a mix of credit in your file like a mortgage, car loans or a credit card shows that you can handle multiple debts.

Want an in-depth breakdown of your credit score? Check out our helpful article on all the categories that make up your score.

Prepping to Downsize?

Not only are we here to help with your home buying needs, we’re also ready to help you move into your next home. We can’t pack up the pots and pans, but we can start you in the right direction! If you’re thinking about downsizing, there are steps you can take to know what you can and cannot afford. Additionally, there are ways you can prepare your home to appeal to potential buyers. Here are some great steps to take if you are ready to downsize to your ideal space.

-

Changing your living situation can also mean a potential increase to your mortgage costs. Even if you’re downsizing, the cost could be more. As an example, you could be going from a $200,000 home to a $300,000 condo. Before making the move, review your finances and make sure you’re comfortable with a new monthly mortgage cost.

-

Chat with a real estate agent before starting a home improvement project. You may think a particular project will add a lot of value, but it may not be what people in the market are looking for. Sometimes simple aesthetic updates are the most worthwhile investments when you're preparing to sell your home. Your real estate agent can help you determine what looks most appealing to a buyer, to get you the best bang for your buck.

-

Declutter your home before you put it on the market. Make it as simple as possible so buyers can imagine themselves in the home. Removing clutter can also make rooms appear larger and more appealing.

-

The best first step in this process is to talk with an experienced loan officer. Set up a meeting so they can walk you through the process and create a comfortable timeline. Establish what you need to do with your home beforehand, and what actions you can take to feel financially stable going forward.

A loan officer will break down where you are financially and make recommendations on what you can afford and what you should avoid purchasing. For example, if you’re planning on buying a new car while you plan to move, they may recommend pushing off the purchase of a new vehicle until the following year. Our loan officers can help you get a holistic look at the entire process before taking the next steps.

Refinancing or Downsizing?

Whether you’re downsizing your living situation or moving someplace warmer, it’s important to be prepared. If 2025 is your year to move, we have the resources to get you ready. Attend a seminar or talk with a mortgage loan officer to get information on today’s homebuying process.

Don’t Let Debts Linger

Between a mortgage, medical expenses and other bills, it’s normal to feel like the finish line is far away. Give yourself a second wind by crafting a budget and assuring your monthly expenses are covered.

How to Stay on Budget

- Do Your Research: Read articles, watch videos or see what family and friends have done.

- Find a Plan: Choose a budget style that works best for you like the envelope system or 50-30-20.

- Talk to a Pro: Chat with a financial expert about different ways to tackle debts.

- Stay Aware: Always reevaluate when necessary and make a habit of keeping your goals on hand.

Master Your 2025 Budget

While you may have used a budget plan before, there are plenty of new ones to try out. A budget is never a bad route to take when attempting to pay off remaining debts. Try out one of the popular methods below.