Which Checking Account is Right for You?

Choose the best checking option for your business

Whether you have a large, established company or a new small business, we have something for everyone.

-

Free Business Checking Plus Dividends

Schedule AppointmentDesigned For

Businesses with 100 or fewer transactions in a month

Monthly Maintenance Fee

$0

Rate/APY1

0.05%

Minimum Daily Collected Balance

(Minimum to open an account may be required.)$0

Transaction Fee2

100 Free

20¢ for each transaction after 100

See complete list of fees

Free Visa® Debit Card

Yes

Earn Dividends3

Dividends will accrue every day the account balance is $2,500 or more

-

Business 250 Checking Plus Dividends

Schedule AppointmentDesigned For

Businesses with 250 or fewer transactions in a month

Monthly Maintenance Fee

$0

Rate/APY1

0.05%

Minimum Daily Collected Balance

(Minimum to open an account may be required.)$2,500 ($10 monthly fee if below)

Transaction Fee2

250 Free

20¢ for each transaction after 250

See complete list of fees

Free Visa® Debit Card

Yes

Earn Dividends3

Dividends will accrue every day the account balance is $2,500 or more

-

Business 600 Checking Plus Dividends

Schedule AppointmentDesigned For

Businesses with 600 or fewer transactions in a month

Monthly Maintenance Fee

$0

Rate/APY1

0.05%

Minimum Daily Collected Balance

(Minimum to open an account may be required.)$5,000 ($10 monthly fee if below)

Transaction Fee2

600 Free

20¢ for each transaction after 600

See complete list of fees

Free Visa® Debit Card

Yes

Earn Dividends3

Dividends will accrue every day the account balance is $2,500 or more

-

Commercial Checking

Contact Cash ManagementDesigned For

Businesses who carry large balances & write and deposit more than 200 checks/month

Monthly Maintenance Fee

$10

Earnings Credit Rate

Competitive

Minimum Daily Collected Balance

(Minimum to open an account may be required.)$0

Transaction Fee2

Refer to Fee Schedule

See complete list of fees

Free Visa® Debit Card

Yes

Other Business Account Options

Free Community Checking Plus Dividends

Do you need a checking account for your community group or club? This checking account is the perfect option for groups with minimal activity.

- No minimum balance required

- No monthly maintenance fee

- Dividends are calculated by the daily balance method which applies a daily periodic rate each day the account balance is $2,500 or more

- Dividends will be compounded monthly and credited monthly

IOLTA Checking for Attorneys

We’re proud to support attorneys making a difference throughout Wisconsin. We’re the only credit union Prime Partner of the Wisconsin Trust Account Foundation (WisTAF), the civil legal aid funding administrator established by the Wisconsin Supreme Court.

Are you an attorney interested in opening an IOLTA Checking Account?

Business Banking FAQs

-

Absolutely! Our business digital experience is tailored to streamline your ongoing management tasks, ensuring that your sub-users have seamless access to essential features and services.

Here's what you should be aware of regarding sub-user access in business digital banking:- Efficient Permissions & Limits Assignment: Assigning permissions and limits has never been more efficient. You can now allocate permissions and limits simultaneously, ensuring accuracy and saving you time.

- Readability & Content Organization: We present summary views of user access, permissions, and limits, along with categorized sections that make managing information more manageable and editable.

- Mobile-Friendly Experience: Managing sub-users isn't confined to desktops anymore. Our mobile experience allows business owners, employees, and contractors to easily adjust user permissions, set limits, reset passwords, and view account access while on the move.

Ready to empower your Business Digital Banking with a sub-user?

If you need further assistance with Business Digital Banking, contact our Cash Management team. -

You can easily add a Sub-User by following these steps:

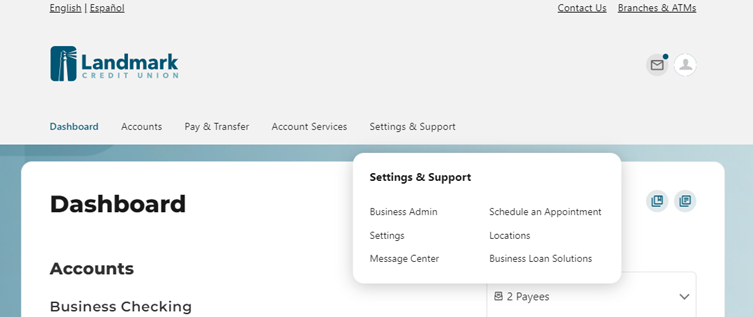

- Under Settings & Support, select Business Admin

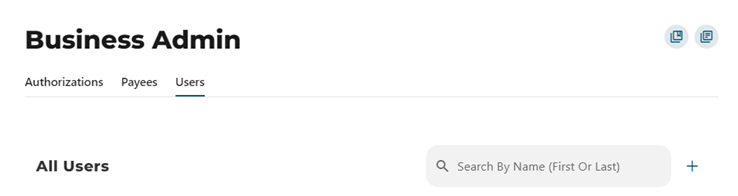

- Select Users

- Under the Users section, look for the "+" symbol. Click on it to initiate the process of adding a new user

- Create a New User: This option will guide you through setting up the new user's access rights step by step.

- Copy an Existing User: If you already have a user with the desired access rights, you can copy their settings to the new user.

If you need further assistance with Business Digital Banking, contact us.

-

Yes, a car can be titled in the name of your business. Please let us know if this is how you'd like to title your car at the time of application.

-

Yes, we offer a variety of business loans including real estate, construction, equipment, and more. Please visit our Business Loans page to learn more.

-

Yes, we do! Please visit our Cash Management section to learn more.

-

Yes, we partner with a company called Elavon to enable members with business accounts to accept various forms of credit card and gift card payment. Please contact us or visit one of our branches to learn more.

-

Yes, we do offer business accounts for sole proprietorships. Please contact us or visit one of our branches for assistance.

-

You can open a business account at a Landmark branch. Schedule an appointment today to open a business account. Certain information, including but not limited to, tax identification number, signer's proof of identity and a satisfactory ChexSystems record, is mandatory for opening a business account. Depending on the specific type of your organization, other documentation, such as state filed organization papers and operating agreement, among other things, may be required. Contact our business team for more information about the specific requirements for your organization.