Brian Melter, Chief Experience Officer

You might think you’d never fall for a financial scam, but as the Chief Experience Officer at Landmark, I’ve seen how sophisticated and clever modern scammers can be and how rampant these scams have become.

All of us at Landmark want to make sure you keep an eye out for these common scams and know how to protect yourself and your finances.

Check Fraud

The Scam: Believe it or not, check fraud is one of the hottest scams currently. This might seem like an old school crime that you remember from watching the movie, Catch Me if You Can, but today’s criminals have taken it to the next level with new technology. Thieves can steal checks from mailboxes, chemically remove the payee and amount written, add in their own details, and then deposit the checks into their own accounts.

How to Protect Yourself: Avoid putting checks in your mailbox or in the outdoor blue US Postal Service collection boxes, some of which were recently reported to have been compromised in our area. Use Digital Banking to pay your bills electronically when possible (and in most cases, your payment will arrive faster, and you’ll save on the cost of a stamp, a check, and an envelope too!).

Want to send birthday or holiday money to a loved one? Use Zelle® within Digital Banking as a fast and easy way to send money to family and friends. If you must send a check by mail, drop it off inside at the Post Office. And while it always looks good to your beloved gift recipient, never send cash!

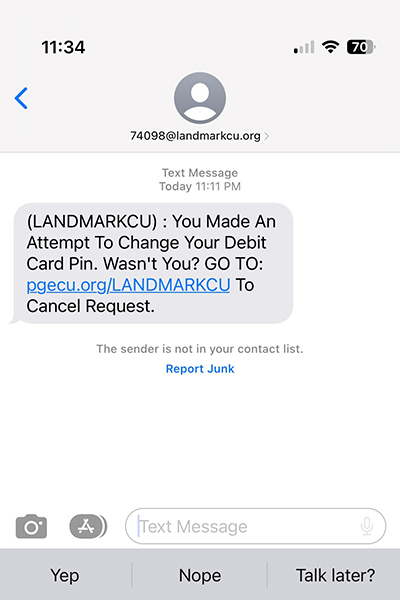

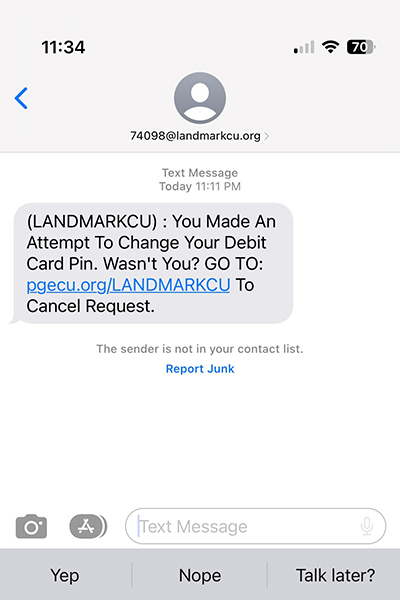

Financial Institution Impersonation

The Scam: You get an email, phone call or text message that appears to be from Landmark or another financial institution. They tell you your account has suspicious activity and ask you to provide sensitive information such as a security code, account number or your Social Security Number. Using techniques like spoofing phone numbers, email addresses and websites, fraudsters try to trick people into sharing sensitive information to gain access to their money.

How to Protect Yourself: Know that Landmark and other reputable institutions will never send you an unprompted message or call asking you to provide personal information. If you receive a questionable email, don’t click any links or download any attachments. Instead, delete the email and report it to your email provider. If you get a suspicious phone call, hang up immediately and call your financial institution directly with a phone number from your statement or the back of your debit or credit card. When visiting a financial institution’s website, enter their URL directly such as landmarkcu.com instead of using a link.

Also, be sure to enable multi-factor authentication hackers can’t access your accounts with a password alone. Keep your email secure as well by using a different password than you use with other institutions. We have seen a one-two punch of fraudsters not only trying to gain access to financial accounts but also to email accounts to steal even more sensitive data.

Family Emergency

The Scam: You get a phone call, email, text message or a social media message that appears to be from a family member in distress saying they need money urgently. They might say they’ve been in an accident or are stuck in a foreign country while traveling. They’ll even throw in personal details they picked up from social media to make it sound convincing. They might plead with you to send money quickly and keep it a secret from other family members. Sadly, fraudsters often target grandparents with these types of scams, pretending to be a grandchild in need.

How to Protect Yourself: If you get a call or message like this, you should stop and call your relative directly. Don’t be afraid to contact other family members to verify the situation. No one should be pressuring you to send money immediately. As a preventative measure, check your social media privacy and security settings to ensure scammers can’t gather your personal information from Facebook, Instagram, Twitter or other platforms.

When in doubt, take a pause and contact us. There is nothing embarrassing about asking the right questions, double checking on things and taking your time to validate information. We’re here for you and are happy to help you assess whether the request you’ve received is legitimate.