Looking to make some upgrades to your home or need some cash for home repairs? Here is some insight on how to use your home’s equity to accomplish those goals.

Finding equity in your home

As a homeowner it is always good to find ways to continuously build equity in your home. Equity is the difference between what you owe on your current mortgage loan and the home’s current market value. A great way to build this is by making home improvements, updates or additions. However, remodeling your kitchen or making your basement the hangout spot you always wanted is easier said than done and can rack up your credit card bill if you’re not careful. This is where HELOCs and Home Equity Loans come into play! A Home Equity Loan or a Home Equity Line of Credit (HELOC) will allow you to tap into your home's equity, using your home as collateral. If you already have a mortgage, this will create another lien on your household. If you decide to apply for one of these loans, talk with a Landmark personal finance officer. They will walk you through the application and calculate how much you can take out based on your combined loan-to-value ratio (LTV). This is an easy process that can benefit you and your home in the long run.

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit with a variable interest rate. The interest rate for your line of credit will be based on multiple factors including the combined loan-to-value ratio and credit score to name a few. After your application has been approved you will enter the draw period of the loan. During that time, you will only need to pay back the interest on the outstanding balance. The amount of time you have to draw funds may differ depending on the type of loan you have selected.

Since this is a revolving line of credit you can take draws up to your approved limit. As you pay your balance down, you can draw funds again if needed. Even after you have paid off the line amount borrowed you can continue to draw funds.

A HELOC is generally used for individuals who:

- Work on various/changing home improvement projects

- Might have unknown expenses in their budget

- Are comfortable paying variable interest-only payments

- Want to keep a line of credit readily accessible

Draw and repayment - HELOC

During the draw period for a HELOC (the timeframe you can borrow money) the only payment requirements will be on the interest portion of the outstanding balance. After the draw period ends, you will enter the repayment period and you will no longer be able to draw additional funds from your HELOC. When in the repayment period, payments on the principal balance as well as the interest will be due for the funds you have withdrawn.

What is a Home Equity Loan?

Home Equity Loans will give you a lump sum of cash which is repaid over a fixed period with a fixed interest rate. This loan comes with a low fixed interest rate and fixed monthly payments over the life of the loan. Landmark makes it easy to apply with your personal finance officer and offers terms that can fit your budget ranging from 5-20 years. This style of loan works well if you know the exact amount you wish to spend and do not foresee additional projects popping up in the future. You also have peace of mind knowing exactly what you will be paying on a month-to-month basis. Keep in mind that you will not be able to draw additional funds from your Home Equity Loan. You can apply for an additional Home Equity Loan if more funds are needed, however, if you find that you need additional funding a HELOC may be a better choice.

A Home Equity Loan is best suited for homeowners who:

- Know the exact amount of cash they need for a home improvement project

- Prefer consistent payment options

- Prefer lower interest rates than other options (such as credit cards)

The Landmark Difference

- A common myth when applying for a home equity loan involves the time it will take to get your loan approved and processed. While some financial institutions take 40-60 days, Landmark turnaround times are often a fraction of that! Of course, outliers and certain situations can delay this time frame, but we will always keep you informed when those situations arise. Schedule an appointment with a Landmark personal finance officer if you want to find out more.

- Most remodeling projects or major renovations can take a long time. Whether it’s supply chain issues, permit issues or contracting problems, projects can often be pushed out. That’s why having a good rate is important for the life of your loan or line of credit. At Landmark we offer a standard HELOC rate of Prime minus 1.00%18 APR.

Depending on the financial institution, you may see varying intro or promotional rates for a set number of months. Make sure you evaluate these rates and calculate the life of the loan against your plans. If your project takes longer than the set number of months on that promo, your rate could jump, and it may end up costing you more in the long run. If you want to learn more about the rates offered at Landmark, contact us, or schedule an appointment!

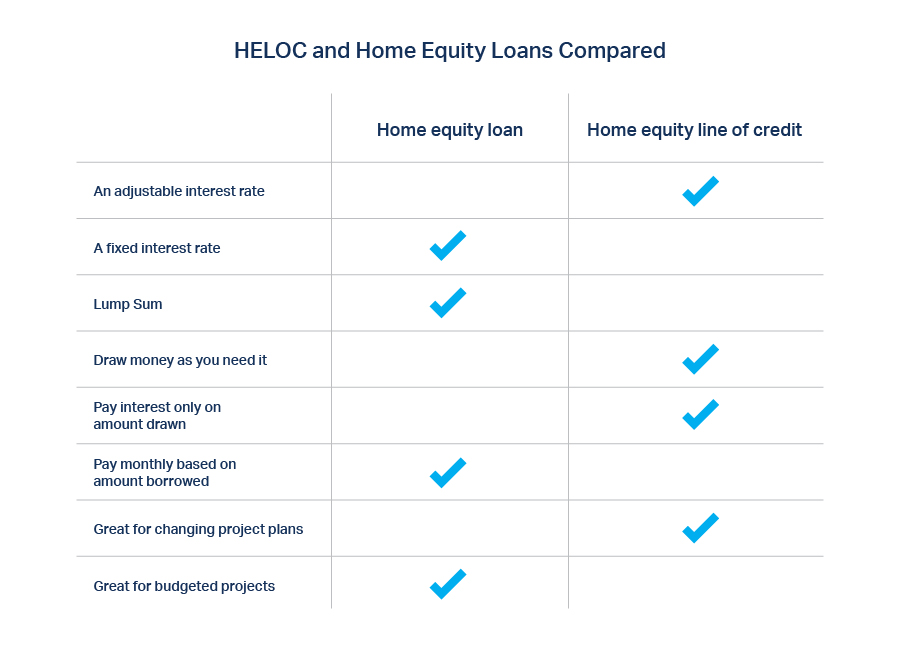

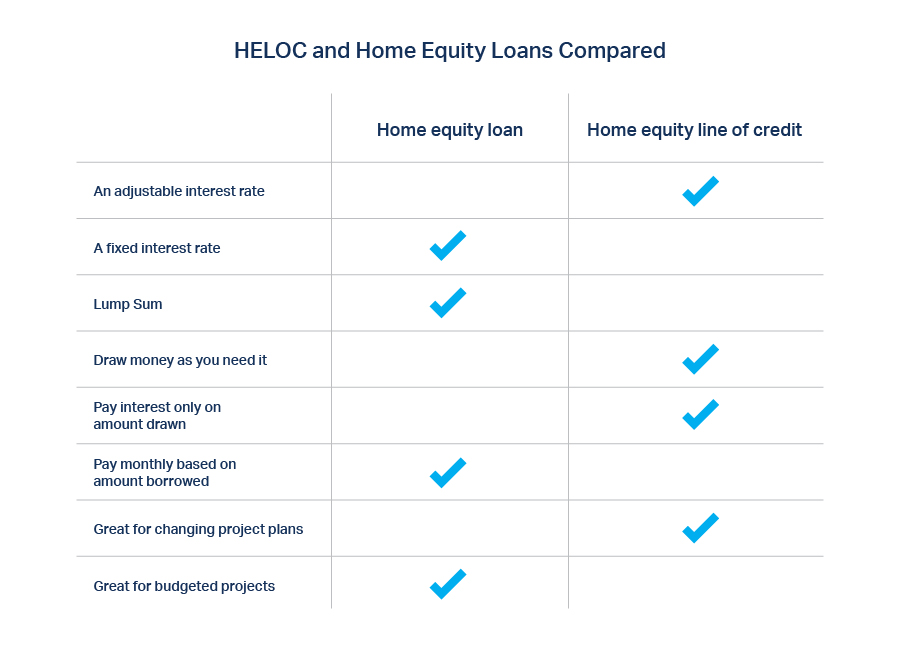

Home Equity Loan or HELOC – What’s best for you?

A Home Equity Loan and a HELOC can offer various benefits to better serve you and your home. Knowing the advantages of a Home Equity Loan and HELOC can save you money in the long run and is much more affordable than putting projects on a credit card! First, carefully review your personal finances and make sure you are making the decision that best suits your needs. Then, check out our current rates to help answer any additional questions you may have.

Let Landmark work with you to accomplish your goals with a Home Equity Loan or HELOC!

SCHEDULE AN APPOINTMENT!

APPLY NOW!