Tax Forms

| December 2025 Statement | Landmark members with an open account | January 8th |

| 1098 | Home equity or mortgage loan interest paid | January 31st |

| 1099-Int | Dividends earned on deposit accounts | January 31st |

| 1099-R | IRA distributions | January 31st |

| 1099-SA | HSA distributions | January 31st |

| 1099-Q | Coverdell Education Savings account distributions | January 31st |

| 5498 | IRA contributions and rollovers | May 31st |

| 5498-SA | HSA contributions and rollovers | May 31st |

| 5498-ESA | Coverdell Educational Savings account contributions and rollovers | May 31st |

The availability date for online forms may vary from the mailed-by date listed above. Although we strive to provide your interest statements online, certain unique circumstances may prevent us from loading the notice into Digital Banking, making it inaccessible for online viewing. If you prefer a paperless approach for tax statements and forms, we encourage you to enroll in Digital Banking.

Accessing Tax Forms

- Log into Digital Banking

- Hover over "Accounts" in the top navigation

- Click Statements & Documents

- Click Tax forms tab

To view your statements, you need to subscribe to eDocs. If you are not subscribed, you will not see your Tax Forms.

To Subscribe to eDocs

- Log into Digital Banking

- Hover over "Accounts" in the top navigation

- Click on "Statements and Documents"

- Under the "Overview" tab, click the "Subscribe" button

- Accept the user agreement

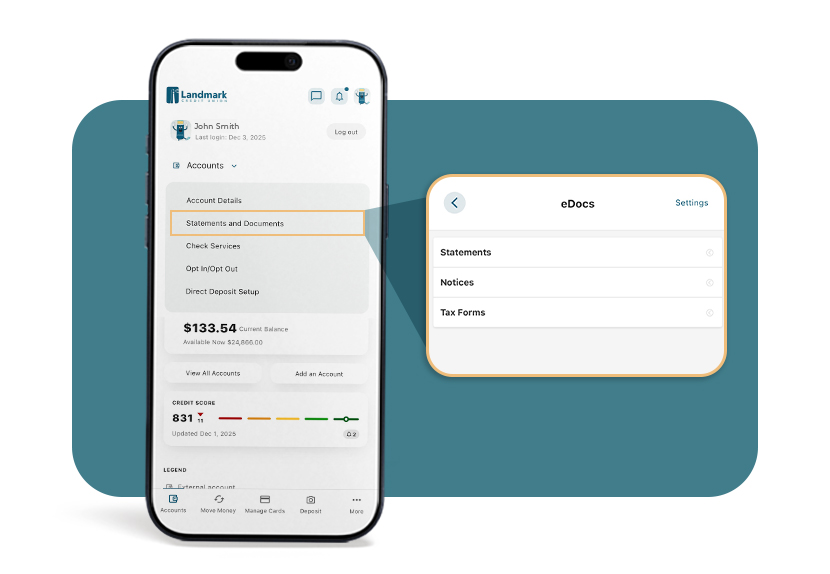

- Log into the mobile app

- Tap 'More' from the bottom navigation

- Tap 'Accounts'

- Tap "Statements and Documents"

- Tap 'Tax Forms"

To view your statements, you need to subscribe to eDocs. If you are not subscribed, you will not see your Tax Forms.

To Subscribe to eDocs

- Log into the mobile app

- Tap 'More' from the bottom navigation

- Tap 'Accounts'

- Tap "Statements and Documents"

- Tap "Settings" in the upper-right corner

- Tap "Subscribe" in the upper-right corner

- Review and Accept the user agreement

- Tap "Subscribe" in the upper-right corner

Mortgage Escrow Property Tax Payments

If you selected to have your taxes paid in December, the municipality will issue the payment by December 31st. If you selected January, the municipality will issued the payment by January 31st.

Direct Deposit Your Refund

Two pieces of information are needed to set up direct deposit into your Landmark account for your tax refund.

Routing Number

Landmark Credit Union's routing number is 275079714.

Account Number

You can find your account number in the following places:

Digital Banking

- Log into Digital Banking

- Click on the account name listed under "My Accounts" (left hand column)

- Click on "Account Details" drop down under account name

- The "ACH Number" is your account number

Mobile App

- Log into mobile app

- Click on the account name you’d like the number for

- Click the "details" link

- The "ACH Number" is your account number

Printed or Online Statement

Your account numbers are listed on your monthly member statements.

Tax Season FAQs

-

The principal balance reflected on your 1098 is the principal balance at the beginning of the year, or the original loan amount if your loan originated last year. It is not the principal balance at the end of the year.

-

You can access your 1098 tax form within Digital Banking or the mobile app.

Find your tax documents in Digital Banking by hovering over “Accounts” in the top navigation, clicking on “Statements and Documents” and then clicking on the “Tax Forms” tab. -

You bet!

Digital Banking Instructions- Log in to Digital Banking

- Hover over "Accounts" in the top navigation

- Click "Statements and Documents"

- Select the "Tax Forms" tab

- Log in to the mobile app

- Tap "More" in the bottom navigation

- Expand the "Accounts" menu

- Tap "Statements & Documents"

- Tap "Tax Forms"

-

If you would like to change the month your tax payment is submitted or cancel your escrow account so you can pay your taxes directly, you will need to put the request in writing or fill out a new Tax Option Form. You can obtain this form by contacting us.

-

If you need a copy of your tax bill, you should contact your municipality directly. Landmark receives only the amount of the outstanding taxes and does not have a copy of the actual bill.

-

If you chose to escrow for taxes with Landmark, we obtain your real estate tax amount and pay the taxes directly to the municipality as they become due. Tax payments will be noted on your billing statement.

-

Members who earned more than $10.00 of interest during the year will receive a 1099 form in the mail. These forms are postmarked by January 31 of each year.

If you are registered for eDocuments, you can obtain a duplicate copy via Digital Banking by hovering over "Accounts" in the top navigation, clicking on "Statements and Documents" and then clicking on the "Tax Forms" tab. -

Landmark will pay the total property tax amount that is due. If the amount was more than the available escrow balance, the monthly payments to your escrow account would increase to cover the shortage over the next 12 months beginning in March. If you have an overage in your escrow account over $50.00, a check will be mailed to you by the end of January to mid-February.

If you have additional questions, please contact us. -

The IRS requires financial institutions to report the amount of interest paid to you in a calendar year. The form is mailed to you and postmarked by January 31 of each year. Please note, if the total interest paid to you is less than $10, a 1099INT will not be issued. You can find the total interest paid to you during the year on your December statement.

-

Landmark's Federal Tax ID number is 39-0203995.