Retirement Travel Tips: Explore More, Spend Less

Posted: November 10, 2025

Updated: November 10, 2025

Retirement is the perfect time to explore new places, but many retirees worry about the cost of travel and how it fits into their fixed income. The good news? With smart planning, you can still enjoy meaningful adventures without overspending.

We’ll walk you through practical retirement travel tips designed to help you stretch your budget while still experiencing the joys of exploring, whether that means crossing the ocean or discovering hidden gems along Lake Michigan.

Maximize Travel Rewards

One of the easiest ways to make budget-friendly travel possible in retirement is to take advantage of travel rewards. Credit cards that offer points or miles on everyday purchases can translate into free flights, hotel stays or rental cars.

Get the most out of your rewards:

Concentrate Spending: Use one primary card to rack up points faster. Consider using it for your larger expenses.

Pay in Full: Always pay your balance each month to avoid interest charges.

Look for Bonuses: Many cards offer large sign-up bonuses if you meet minimum spending requirements.

Even if you prefer to travel regionally, rewards can help cover gas, dining or lodging along the way.

Travel Off Season (The Power of Slow Travel)

Timing is everything when it comes to affordable travel for retirees. Take advantage of flexibility in your schedule. Popular destinations often have peak and off-peak seasons. By traveling just before or after the busy months (like May or September), you’ll benefit from:

Lower Airfare and Hotel Rates: Savings can often range from 20% to 50% compared to peak holiday weeks.

Fewer Crowds and Shorter Lines: Enjoy a more relaxed pace and a better experience at museums and attractions.

Long-Term Stay Discounts: Consider "slow travel," like renting an Airbnb or VRBO for 30 days or more. Many hosts offer substantial monthly discounts, making extended stays surprisingly affordable and allowing you to live like a local.

For example, visiting Door County in early fall offers beautiful scenery at a fraction of the summer price.

Tap Into Senior Discounts and Memberships

Don’t be shy about asking for senior discounts – they add up quickly and are a huge benefit of travel in retirement. Many airlines, hotels and attractions offer reduced prices for those 55+, 60+ or 65+. You can also find deep savings through memberships like AARP or AAA.

Must-Have Senior Travel Discounts:

National Parks Lifetime Senior Pass: For a one-time fee of $80 (for U.S. citizens/residents 62 and over), you get lifetime access to all U.S. National Parks and Federal Recreational Lands(Opens in a new window), plus discounts on some amenity fees. This is a massive value for nature lovers.

Transportation Discounts: Inquire about discounted Amtrak fares, regional bus services and even select international rail passes.

Cruise Line Senior Rates: Many cruise lines offer exclusive rates or onboard credits for passengers over a certain age.

Always ask at the time of booking or check online. You may be surprised how many opportunities exist!

Explore Local and Regional Destinations

Not every trip needs to be a cross-country flight. Some of the best travel experiences are found just a short drive away. Local and regional trips often mean lower costs and less planning.

Here are a few ideas for affordable regional getaways:

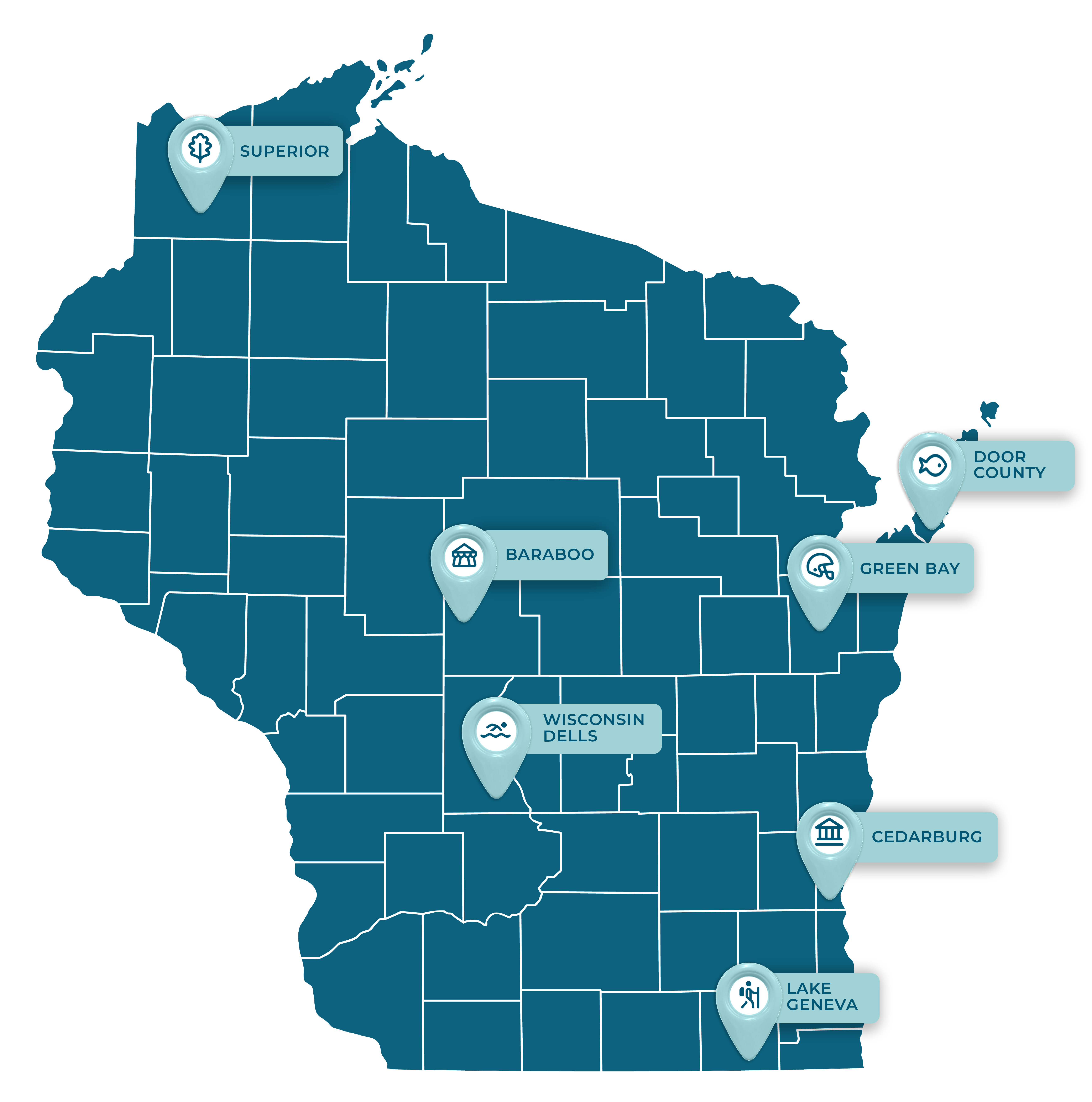

Door County Peninsula: A top-rated retirement and travel destination, this region offers over 300 miles of scenic shoreline. Explore quaint villages like Fish Creek and Sister Bay, visit historic lighthouses, walk along Lake Michigan's rocky shores at Cave Point County Park and indulge in a traditional Door County fish boil dinner.

Green Bay: For sports fans, a pilgrimage to Lambeau Field is a must. You can tour the stadium, and the Green Bay Packers Hall of Fame offers "Senior Series" events and has excellent accessibility, including wheelchair availability and elevators. Beyond the game, visit the Green Bay Botanical Garden, explore the National Railroad Museum or take a free stroll along the Walk of Legends near the stadium.

Baraboo: The historic hometown of the Ringling Brothers, Baraboo is famous for the Circus World Museum, a unique and nostalgic cultural experience. For nature lovers, it's right next to Devil's Lake State Park, which offers stunning bluffs and easy hiking trails. Other affordable activities include touring the historic Al Ringling Theatre and visiting the International Crane Foundation.

Superior: Located on the shores of Lake Superior, this city is a more budget-friendly option in the northern part of the state, boasting one of the lowest costs of living in Wisconsin. It offers stunning access to the Great Lakes and the Apostle Islands National Lakeshore. While the winters are cold, the summers offer fantastic opportunities for boating, fishing and enjoying the peaceful environment.

Wisconsin Dells: Known as the “Waterpark Capital of the World,” the Dells offers much more than slides. Take a relaxing Dells Boat Tour or a land-and-water "Duck Ride" to experience the dramatic sandstone cliffs and gorges, like Witches Gulch. For history and low-cost fun, visit the H.H. Bennett Studio, stroll the accessible Scenic River Walk for free river views or explore the quaint shops and German clock in the Bavarian Village. You can also enjoy a hike at nearby Mirror Lake State Park.

Lake Geneva: A perfect weekend getaway destination with a serene, upscale atmosphere that is surprisingly affordable. The highlight is the Shore Path, a free, 26-mile public trail that runs along the entire lakefront, passing through the yards of historic mansions. Find affordable lodging in the off-season or just blocks from the water. Enjoy charming downtown shopping, visit the Geneva Lake Museum for local history, or spend an afternoon at Big Foot Beach State Park for a low daily fee.

Charming Cedarburg: Spend a day or a weekend exploring this historic town north of Milwaukee, known for its preserved limestone architecture, unique boutiques and relaxed, walkable downtown area. Many of the town’s museums, like the Cedarburg Art Museum and the Cedarburg History Museum, offer free admission or senior discounts. You can stroll or bike a section of the paved, accessible Ozaukee Interurban Trail, or visit the nearby Cedarburg Covered Bridge for a free photo op. Time your trip for one of the city's free annual festivals, such as Strawberry Festival or Oktoberfest.

Day trips and regional getaways give you the chance to enjoy travel in retirement more often without breaking your budget.

Health and Safety Travel Tips for Retirees

While a focus on savings is important, neglecting health and safety can lead to unexpected, catastrophic costs.

Travel Insurance is Non-Negotiable: Because medical emergencies are more common with age, securing comprehensive travel insurance for longer distance trips is smart. Look specifically for policies that cover pre-existing conditions and offer high limits for emergency medical evacuation.

Manage International Fees: If traveling abroad, avoid dynamic currency conversion (paying in U.S. Dollars instead of the local currency).

Stay Connected: Always carry a charged phone and share your daily itinerary with a friend or family member back home.

Manage Expenses While Traveling

Keeping costs in check while you’re on the road helps you stay within your travel budget without feeling deprived.

Some simple tactics include:

Book Accommodations With Kitchens: Preparing a few meals yourself saves money and allows you to experience local grocery stores and markets, a form of cultural immersion itself!

Plan Free Activities: Look for walking tours, public parks or free local events that add richness to your trip without extra cost.

Use Public Transportation: Buses, trains and trams are usually cheaper (and more fun) than taxis or rideshares, offering a true sense of the destination.

The Bottom Line

Travel in retirement doesn’t have to be expensive. By maximizing rewards, traveling off-season, using senior discounts and exploring local destinations, you can enjoy meaningful experiences without straining your budget. Whether you’re planning a cross-country trip or a weekend getaway close to home, these strategies will help you stretch your dollars and make every journey memorable.

Before you book your next flight, make sure your retirement fund is built to handle it. Landmark Investment Center’s financial consultants can help you budget for travel and explore options like generating monthly income streams, all while keeping your core retirement goals on track. Connect with us today to start planning a secure, travel-filled retirement.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All investing involves risks including the possible loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This material was prepared by LPL Marketing Solutions and Landmark Investment Center.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Landmark Credit Union ("Financial Institution") provides referrals to financial professionals of LPL Financial LLC pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Landmark Credit Union and Landmark Investment Center are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Landmark Investment Center, and may also be employees of Landmark Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Landmark Credit Union or Landmark Investment Center. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Landmark Credit Union Guaranteed | Not Landmark Credit Union Deposits or Obligations | May Lose Value |