How Much Should You Save in Your 401(k) – By Age

Posted: October 14, 2025

Updated: October 14, 2025

How much do you actually need to save for retirement? The truth is, there is no one-size-fits-all number. Your savings goals depend on your lifestyle, income and retirement plans. A 401(k) or a similar workplace plan like a 403(b) can be one of your most powerful tools to build long-term security. Knowing how much to save at each milestone can help you stay on track and adjust along the way.

In this article, we’ll walk through 401(k) savings strategies by age, highlight key retirement milestones and share tips for maximizing retirement savings over time.

Why Age Matters in Retirement Planning

Your 20s and 30s look a lot different from your 50s and 60s, financially and personally. Breaking retirement planning into stages helps you focus on the right actions at the right time. At each stage, consider:

- How much you’re contributing now

- Whether you’re taking full advantage of employer contributions

- If your investment mix makes sense for your time horizon

- What adjustments you should make as you get closer to retirement

Let’s look at what that means for each decade of your life.

- 20s-30s

- 40s

- 50s-60s

Your 20s and 30s: The Power of Starting Early

Your 20s and 30s are the perfect time to start saving for retirement, even if it’s just a small amount. Thanks to compounding on any growth (when your savings earn interest and that interest earns more interest), the earlier you start, the less you’ll need to play catch-up later.

Key Strategies:

- Maximize the Employer Match: Don't leave free money on the table. If your employer offers a match, contribute enough to your 401(k) to get the full amount. This is one of the easiest ways to boost your savings.

- Consider a Roth IRA: For younger workers who expect to be in a higher tax bracket in the future, a Roth IRA can be a great tool. You contribute after-tax money, which means your qualified withdrawals in retirement will be completely tax-free. A Roth IRA can be a powerful complement to your traditional 401(k). A Roth IRA offers tax deferral on any earnings in the account. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply

- Automate Your Savings: Set up automatic payroll deductions to go into a retirement account. This makes saving effortless and consistent, ensuring you stay on track without having to think about it every month.

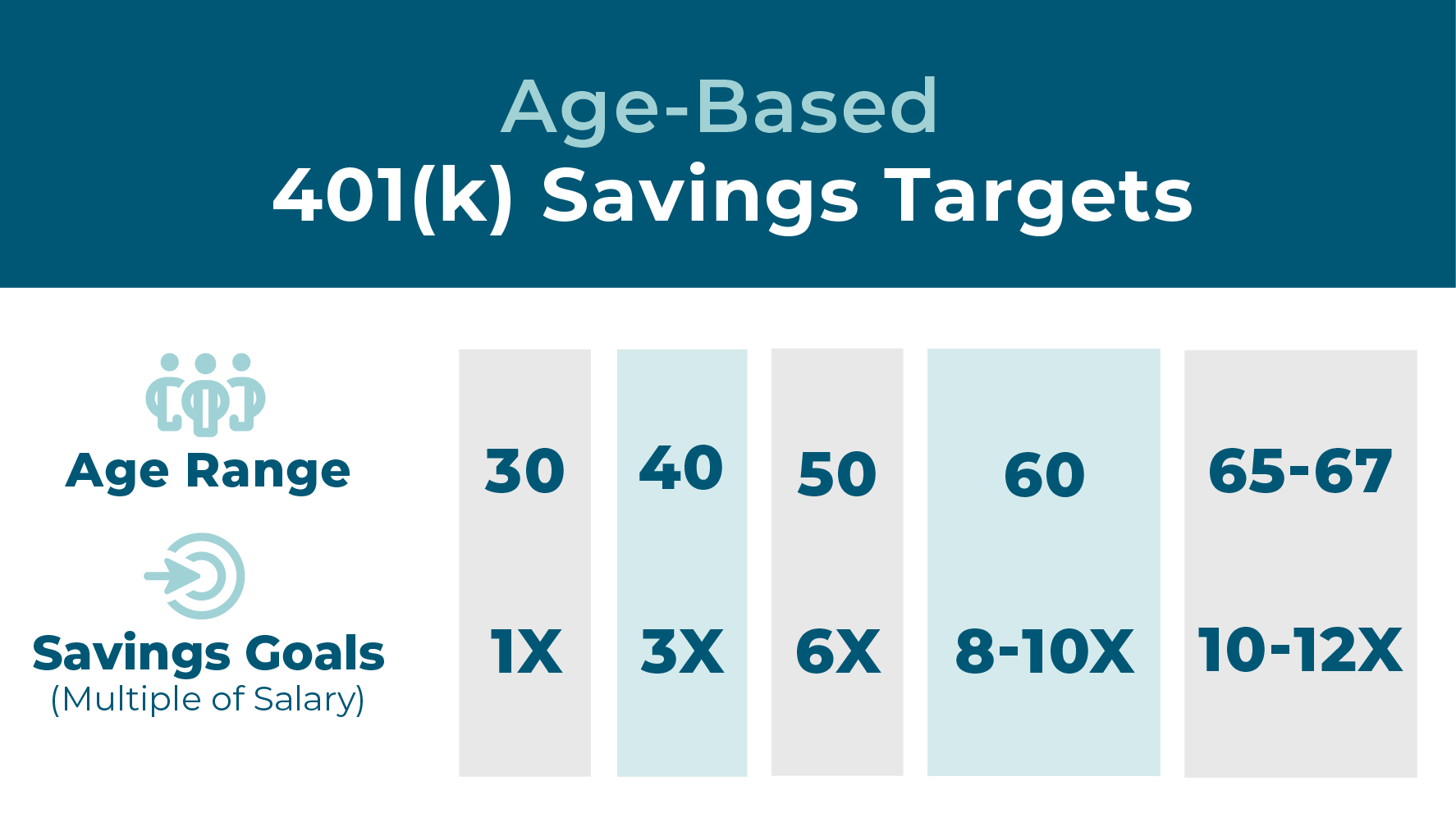

Savings Goal: In your early 20s, it’s most important to just start saving for retirement. By age 30, aim to have about one year’s salary saved for retirement.

Your 40s: Step Up and Close the Gap

Your 40s are often a financial balancing act. You might be raising kids, paying a mortgage or even helping aging parents. But this is also the decade when your retirement savings should really pick up speed.

Key Strategies:

- Increase Your Contributions: Each raise or bonus is a chance to boost your 401(k) by at least 1%.

- Revisit Your Portfolio: As you get closer to retirement, you may want to begin shifting your portfolio balance to lower risk options. This can help preserve your savings from market volatility.

- Check for Gaps: If you’re behind your savings goal, consider increasing contributions each year or redirecting bonuses, raises or tax refunds into your 401(k).

- Think Long Term: Don’t let short-term expenses derail your retirement goals.

Savings Goal: By age 40, aim to have three times your salary saved, and by 50, about six times your salary.

Your 50s and 60s: Catch-Up and Final Adjustments

Now you’re in the home stretch. Use these specific strategies to help you cross the finish line with a solid financial plan.

Key Strategies:

- Take Advantage of Catch-Up Contributions: If you're 50 or older, you can contribute an extra amount to your 401(k) and IRA. This is an incredible opportunity to give your savings one last significant boost.

- Rebalance Your Portfolio: Continue to rebalance your portfolio to be more conservative. As you near retirement, your primary goal is to preserve your savings, not to chase high growth. As you get older, you won't have as much time to bounce back from a drop in the economy as you did when you were younger. A mix of stocks, bonds and cash can help provide a steady income stream in retirement.

- Consider a Roth Conversion: If you expect to be in a higher tax bracket in retirement than you are now, converting a portion of your traditional 401(k) to a Roth 401(k) can be a smart move. A Roth IRA conversion (sometimes called a backdoor Roth strategy) is a way to contribute to a Roth IRA when income exceeds standard limits. The converted amount is treated as taxable income and may affect your tax bracket. Federal, state and local taxes may apply. If you’re required to take a minimum distribution in the year of conversion, it must be completed before converting. To qualify for tax-free withdrawals, you must generally be age 59½ and hold the converted funds in the Roth IRA for at least five years. Each conversion has its own five-year period, and early withdrawals may be subject to a 10% penalty unless an exception applies. Income limits still apply for future direct Roth IRA contributions.

Savings Goal: By age 50, aim to save six times your salary. And by age 60, strive to have eight to 10 times your salary saved. By retirement age (65–67), financial experts recommend 10-12 times your salary for your retirement.

Retirement Savings Tips for All Ages

No matter your stage of life, these strategies can help you work toward staying on track.

- Roth vs. Traditional: The key difference lies in when you pay taxes. With a traditional 401(k), you get a tax deduction now and pay taxes when you withdraw in retirement. With a Roth 401(k), you use after-tax money now, and your withdrawals in retirement are tax-free. This can be an attractive option if you're considered with taxes going up over time. Ultimately, your decision depends on whether you think you'll be in a higher tax bracket now or in retirement.

- Don't Forget About Inflation: Inflation is the gradual increase in the cost of goods and services over time. While it might seem small, it can significantly reduce the purchasing power of your savings over decades. Make sure your investments are growing at a rate that at least keeps pace with inflation. A financial consultant can help you prepare for this.

- Start With Small Steps: The most important step is to simply get started. Start by saving a small percentage of your paycheck and work your way up. Even a little bit of savings today is a monumental step toward a secure future.

Putting It All Together

Saving for retirement is a marathon, not a sprint. Your 401(k) is powerful, but consistency is key. Whether you’re starting in your 20s, catching up in your 40s or fine-tuning in your 60s, every step forward matters. Even small adjustments, like upping contributions by 1% or using catch-up options, can make a big difference.

Not sure if you’re on track? Meet with a Landmark Investment Center Financial Consultant who can help you craft a retirement plan tailored to your financial goals.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All investing involves risks including the possible loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This material was prepared by LPL Marketing Solutions and Landmark Investment Center.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Landmark Credit Union ("Financial Institution") provides referrals to financial professionals of LPL Financial LLC pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Landmark Credit Union and Landmark Investment Center are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Landmark Investment Center, and may also be employees of Landmark Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Landmark Credit Union or Landmark Investment Center. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Landmark Credit Union Guaranteed | Not Landmark Credit Union Deposits or Obligations | May Lose Value |