Top Student Loan Repayment Strategies

Posted: March 1, 2020

Updated: August 5, 2025

Graduation is a major milestone, but for many, it’s followed closely by the challenge of managing student loans. Between job hunting, rent, bills and everyday expenses, repayment can feel overwhelming.

The good news? With a little planning, an early start and the right strategy, you can take control of your finances and get rid of your student debt faster than you think. You worked hard to earn your degree so don’t let student debt hold you back.

Understanding Your Student Loans

It can feel daunting to repay your student loans, but we're here to help you every step of the way! Before we learn all the different ways to repay your student loans, let’s start by breaking them down.

Repaying your loans starts with understanding what you owe. Student loans come in several types and terms, which can affect your strategy. They may be:

- Federal or Private Loans

- Subsidized or Unsubsidized

- Variable or Fixed Interest Rates

- Parent Plus Loans

- Perkins Loans

- Different Loan Providers

It’s safe to say there are a lot of ways to receive funding for your personal education, and it’s good to know what you’re working with before making a plan.

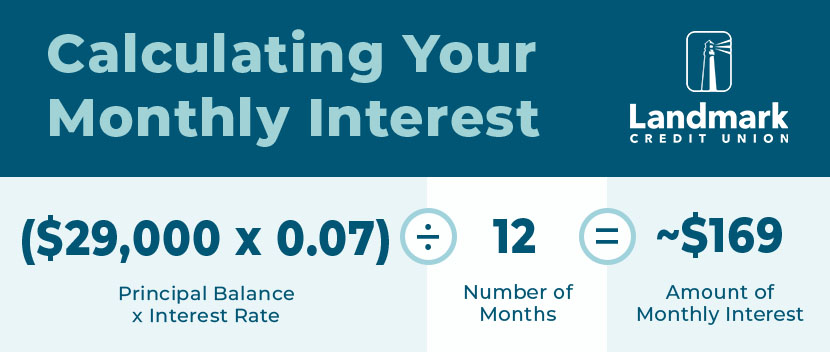

Understanding Interest

Speaking of planning, understanding how interest works on your account is important when learning to pay off your debt faster. Interest is added money that you must pay back on top of your loan principal. It’s calculated as a percentage on that principal, and accrues over time.

Speaking of planning, understanding how interest works on your account is important when learning to pay off your debt faster. Interest is added money that you must pay back on top of your loan principal. It’s calculated as a percentage on that principal, and accrues over time.

*Principal is the original sum of money that you borrowed on your loan.

Strategies for Student Loan Repayment

Time to talk strategy! Check out these student loan repayment strategies to help you pay off your student loans.

Pay More Than the Minimum When You Can

Whenever possible, pay more than your minimum monthly payment. Once your accrued interest is covered, you can make extra payments that go directly toward reducing your principal. Try one of these simple approaches:

- Add a one-time extra payment (an occasional $20 or $40 can make a big impact)

- Round up your regular payment (e.g. $152 a month rounds up to $160 a month)

- Set aside savings throughout the year to make a lump-sum payment

Bonus Tip: use Track Spending in Digital Banking to find “extra” dollars in your budget. Use those dollars to make some extra payments. The more you reduce your principal balance, the more you can save on accrued interest!

Automate Your Payments

A smart plan when paying back your student loans, is to set up automatic payments.

Landmark’s Premium Checking account could be a great fit. With direct deposit, you can set up automatic transfers and even earn interest on your balance while you chip away at your student loans.

Established Strategies: Avalanche vs. Snowball

The debt avalanche and debt snowball methods are great ways to accelerate debt relief. Rather than focusing solely on student debt, these methods look at your total debt in an effort to knock out specific pieces. They help free up funds from other debts to that you can use however you please.

Student debt is often the largest debt on the list, so using the avalanche or snowball is a great way to reduce that total debt!

Avalanche Method: Pay the minimum amount on all loans, then put any extra toward the loan with the highest interest rate. This saves the most on interest over time.

Snowball Method: Focus on paying off your smallest debt first, then roll that freed-up payment into the next smallest debt. It’s great for building momentum and motivation! Want a deeper dive on these strategies? Check out our article on building momentum in debt repayment.

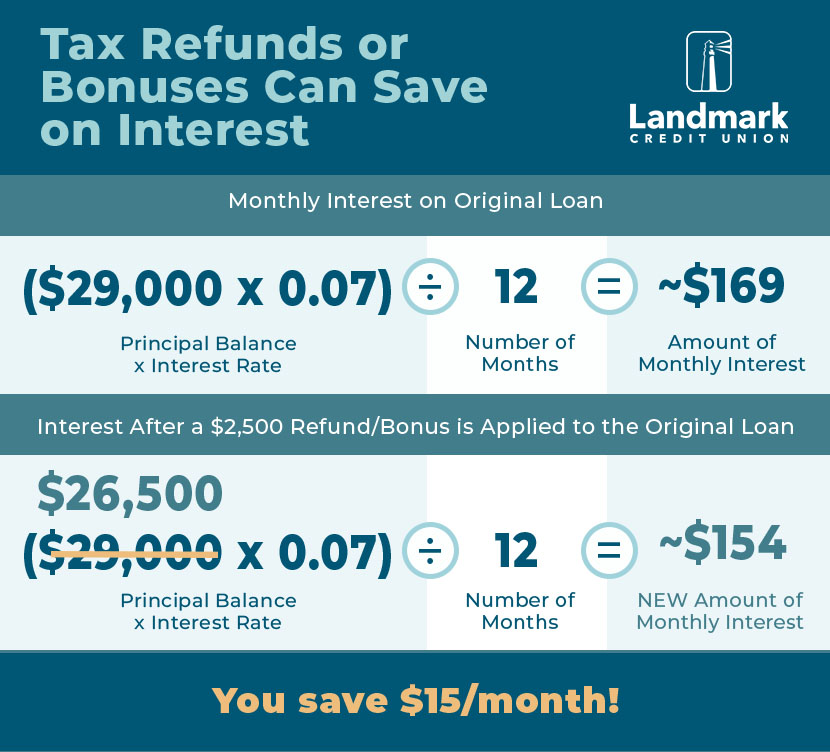

Using Tax Refunds or Bonuses

Use your tax refund or yearly bonus to take a large chunk out of your loan. If you feel comfortable using your refund or any unexpected bonuses you get for a loan, it’s always a great idea to help reduce your payment timeline. Let’s look at a quick example based on the figures we showed above:

- Your original loan: $29,000 at 7% = ~$169 monthly interest

- Use $2,500 from bonuses and tax refunds on your principal

- New loan amount: $26,500 at a 7% = ~$154 monthly interest

Smart Spending: Cut Costs for Added Payments

Take a closer look at your everyday expenses, and see if there are ways you can save. Attend local concerts rather than big shows, catch a shuttle bus to get to the Brewers game rather than paying for parking.

Need help tracking your spending? Landmark’s Track Spending tool can show you exactly where your money goes. Find places you can cut back on and put those extra dollars toward your student loan payments. Here’s an example of a hidden cost you could discover by monitoring your expenses.

- Subscription Creep: Many of us often sign up for free subscription trials not knowing that those trials turn into full paid subscriptions. Always double check that you’re not paying for subscriptions you don’t need.

There are plenty of ways to save money every day. In fact, we have a whole list! Check out our article on 11 Tips That Make Saving Easy.

Strategic Refinancing

If you’re looking for a way to simplify your student loan repayment, refinancing could be a smart move. You’ll be able to consolidate your private and federal student loans into one manageable loan, setting up one convenient payment and potentially lowering your rate.

Work with a Landmark Credit Union associate to help you understand your current loan situation and learn if refinancing could be right for you. Our student loan refinance option features a competitive interest rate and zero origination fees so that you can simplify your life. Explore your refinancing options with Landmark.

Important Note: While refinancing can be a great option, keep in mind when you refinance federal loans that means giving up benefits like income-driven repayment plans and federal forgiveness programs.

Student Loan Forgiveness Programs

You may be eligible for student loan forgiveness without even knowing it. Under certain circumstances, the federal government may forgive some, or all, of your federal student loans. Keep in mind each state, including Wisconsin, may have different requirements for forgiveness.

Some of these circumstances include Public Service Loan Forgiveness, Teacher Loan Forgiveness, Closed School Discharge, Total and Permanent Disability Discharge and more. If you qualify for any of the above, your loans may be forgiven, canceled or discharged.

The Bottom Line

Paying off student loans doesn’t have to feel like a lifelong burden. With the right strategy and a little consistency, you can make serious progress. Use budgeting tools, round up payments and stay proactive by using one or more of these strategies. Choose the approach that fits your life and keep moving forward. You’ve got this!