How To Improve Your Credit Score

Posted: April 4, 2024

Updated: April 4, 2024

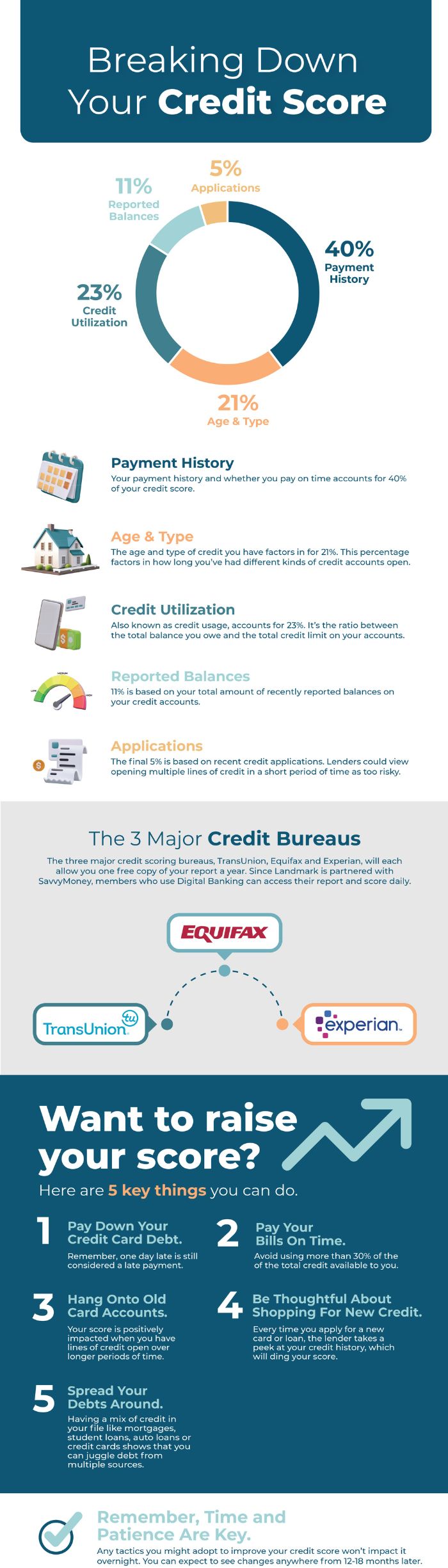

When it comes to credit scores, there is almost always room for improvement. If your score is not where you want it to be, there are several strategies you can consider to give it a boost. But first, you need a little insight into how that score is calculated. VantageScore®, the company that will generate the credit score you receive through our Digital Banking platform, uses five major categories of information. All of which was reported to the credit bureaus by your lenders to generate scores that range from 350 to 850. The higher the credit score the better. Each category is weighed differently.

Pull your credit reports to get started

Before taking the steps to improve your credit it is important to understand what your starting score is. The three major credit scoring bureaus, TransUnion, Equifax and Experian, will each allow you one free copy of your report a year. Since Landmark is partnered with SavvyMoney, members who use Digital Banking can access their report and score daily from VantageScore®. If you get a copy directly from the credit scoring bureaus, we suggest spreading them out by pulling one every four months.

- If you find an error on your report, you should dispute it right away. Errors such as a misspelled name or an incorrect address can be fixed by contacting the creditor and asking for your information to be updated. If they won’t correct it, or the error is more complicated to resolve, you should dispute it directly with the credit bureaus. This can all be done online.

Factors That Determine Credit Scores

Payment History:

Your payment history and whether you pay on time accounts for 40% of your credit score.

Age & Type:

The age and type of credit you have factors in for 21%. This percentage factors in how long you’ve had different kinds of credit accounts open. The longer your credit has been open and the more diverse it is, the more your score can benefit.

Credit Utilization:

Also known as credit usage, accounts for 23%. It’s the ratio between the total balance you owe and the total credit limit on your accounts. It’s best to keep your credit utilization below 30 percent — this is because if you are consistently maxing out your credit cards, it might appear that you're struggling to pay back borrowed funds or are constantly in need of money.

Reported Balances:

11% is based on your total amount of recently reported balances on your credit accounts. You’ll want to keep your balances generally low because that will suggest to lenders that you are capable of making your payments on time.

Applications:

The final 5% is based on recent credit applications. Lenders could view opening multiple lines of credit in a short period of time as too risky. Multiple recent inquiries may worry lenders that you are applying to so many places because you are unable to qualify for credit or because you need money in a pinch. You should avoid opening too many accounts too quickly. When it comes to shopping for a mortgage or car loan your credit score can be affected differently depending on the scoring model that is used.

- Both FICO® and VantageScore® are two separate scoring models that lenders will use to evaluate your credit. Data points like credit inquiries, can influence your score differently for each. Keep in mind that FICO® will count all inquiries within a 45-day period as a single inquiry, while VantageScore® counts all inquiries within a 14-day period as a single inquiry.

Want to raise your score? Here are some key things you can do.

1. Pay your bills on time

Remember, one day late is still considered a late payment. Any late payments can have a negative effect on your score.

2. Pay down your credit card debt

Avoid using more than 30% of the of the total credit available to you. Keeping your usage well below that (closer to 10%) can give your score a boost.

3. Hang onto old card accounts

Your score is positively impacted when you have lines of credit open over longer periods of time. If possible, avoid cancelling your credit cards when you no longer need them so you can keep that positive impact.

4. Be thoughtful about shopping for new credit

Every time you apply for a new card or loan, the lender takes a peek at your credit history, which will ding your score.

5. Spread your debts around

Having a mix of credit in your file like mortgages, student loans, auto loans or credit cards shows that you can juggle debt from multiple sources.

Remember, time and patience are key. Any tactics you might adopt to improve your credit score won’t impact it overnight. You can expect to see changes anywhere from 12-18 months later. It can be shorter if your score is already fairly high and you’re just looking for a bit of jump.

Understanding your credit score is an important part of managing your finances. Make sure you’re using all the tools at your disposal to help you improve your credit score over time. Visit Credit Hub within Digital Banking to get more tips on making those improvements.