How Construction Loans Work

Posted: September 13, 2024

Updated: September 13, 2024

Have you always wanted to build your dream home but weren’t sure how to finance it? Maybe you can't find a home that meets your needs because of limited inventory. Or perhaps you want to make significant renovations to your current home. If any of these scenarios describe your situation, a construction loan might be the perfect solution for you.

Whether you’re only ready to buy land or want to start building, we’ll help you find the best loan type to meet your needs. Let’s break it down by answering some of the most commonly asked questions.

Jump to a question:

Construction Loans

- What is a construction loan?

- What are the benefits of a one-time close construction loan?

- After the construction period, is the mortgage a fixed or variable rate?

- What are construction loan rates?

- What is the required down payment on a construction loan?

- Are loans interest-only during the construction period?

- When is money disbursed with a construction loan?

- What are the requirements to get a construction loan?

- How much of a construction loan can I afford?

- Should I line up financing for construction or meet with a builder first?

- Are construction loans only for new builds?

- What if I have excess funds at the end of construction?

- What are the steps in a construction loan?

Lot Loans

- What is a lot loan?

- What is the benefit of a lot loan?

- What is the required down payment on a lot loan?

- What are lot loan rates?

Construction Loans

What is a construction loan?

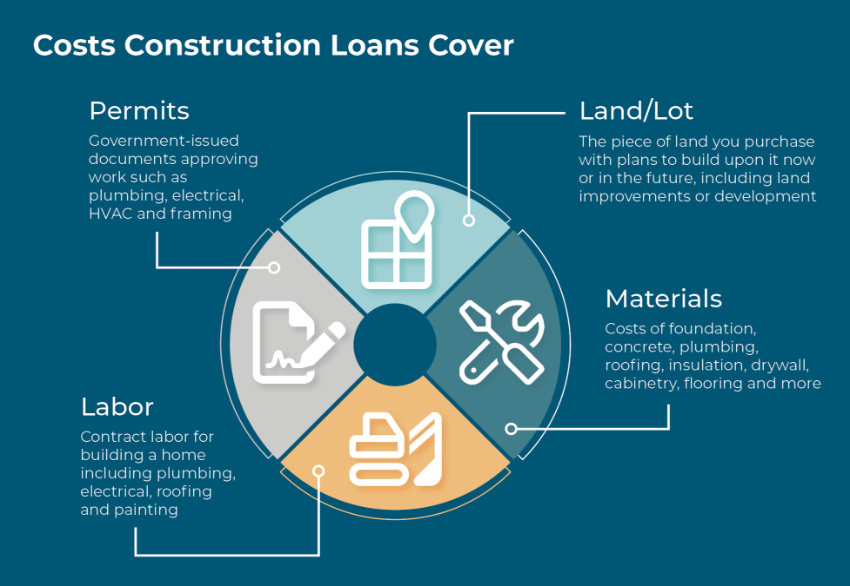

Construction loans are used to finance the building of a new home on a plot of land. Additionally, they can be used for construction projects on an existing home. The financing can cover the costs of land, materials, labor and permits.

At Landmark, we have one-time close construction loans. That means you’ll have one loan, one process and one closing. With permanent financing, you won’t have to refinance into another mortgage. We find it’s the most convenient option for borrowers.

However, some financial institutions offer another type of construction loan called a standalone construction loan. A standalone construction loan is temporary financing that only covers the duration of the building process. At the end of the term, the borrower must pay off the loan.

This is a riskier option because when borrowers refinance the loan into a new mortgage, interest rates might be different and changes in their credit history might impact their loan approval.

Costs construction loans cover:

Land/LotThe piece of land you purchase with plans to build upon it now or in the future, including land improvements or development

Materials

Costs of foundation, concrete, plumbing, roofing, insulation, drywall, cabinetry, flooring and more

Labor

Contract labor for building a home including plumbing, electrical, roofing and painting

Permits

Government-issued documents approving work such as plumbing, electrical, HVAC and framing

What are the benefits of a one-time close construction loan?

You only need to have one closing to cover the full project. That means you’ll only have to gather the necessary financial documents and information one time. You won't have to worry about potential life or credit changes impacting your loan. Plus, you won’t have to pay for the cost of refinancing.

After the construction period, is the mortgage a fixed or variable rate?

At Landmark, our construction loans are Adjustable Rate Mortgages (ARMs), which are variable rate mortgages. If fixed rates are more favorable in the future, you could always explore refinancing your loan. However, if you wanted to simply keep your same mortgage for 30 years, you can!

Fixed Rate vs. ARM MortgagesWith fixed rate mortgages, the interest rate is the same throughout the entirety of a mortgage. An ARM is a variable rate, meaning the rate is the same for an initial period and then changes based on market conditions. For example, your rate might change every year or every five years, depending on the type of ARM you choose.

What are construction loan rates?

View our current construction loan rates.

What is the required down payment on a construction loan?

We require 10% down for a construction loan at Landmark. If you have equity in your lot, you can use that toward your down payment.

Are loans interest-only during the construction period?

Yes, loans are interest-only during the construction period at Landmark. This means that you will not be required to pay toward the principal.

When is money disbursed with a construction loan?

The money is disbursed to the builder in “draws.” The builder can request draws as work is completed. Typically, there are about four draws throughout the construction process, but more might be needed depending on the size of the home being built.

Each time there is a draw, the title company will do an inspection on the property. Not only does this protect the lender, but it also protects you, the borrower, by ensuring the work you are paying for has been executed.

What are the requirements to get a construction loan?

A lender will examine your credit score, your income and your debts to ensure that you’ll have enough funds to make your loan payments.

Lenders, like Landmark, will also want to see that you have built your savings. The additional reserves can create a cushion in case there are unexpected costs that pop up during the building process. Whether the builder discovers an unanticipated problem or you pick out lighting that is more than the builder quoted you for, having money in savings will give you some wiggle room to cover additional expenses.

We’ve compiled a Construction Loan Checklist to help you gather the essential documents and information you’ll need to make your loan application go smoothly.

View Construction Loan Checklist

How much of a construction loan can I afford?

The best way to determine your budget for new construction is to meet with a mortgage loan officer. They can help you navigate through all the facets of a construction loan and determine a comfortable price range for you. Plus, they can provide you with a free pre-approval.

Should I line up financing for construction or meet with a builder first?

If you plan to build your own home, it’s best to line up your financing first. Meet with a mortgage loan officer who can give you an accurate idea of your construction budget before a builder starts drawing up plans.

Are construction loans only for new builds?

No, construction loans can also be used to finance construction on existing homes. Alternatively, if you have significant equity in your home, you might want to explore applying for a Home Equity Line of Credit (HELOC). You could also consider doing a cash-out refinance which would mean refinancing your home for a higher amount and giving you a lump-sum of cash to use for renovations or other needs.

What if I have excess funds at the end of construction?

Although it’s uncommon to have money left over, any unused funds in your construction loan will be given back to you or can be put toward your mortgage.

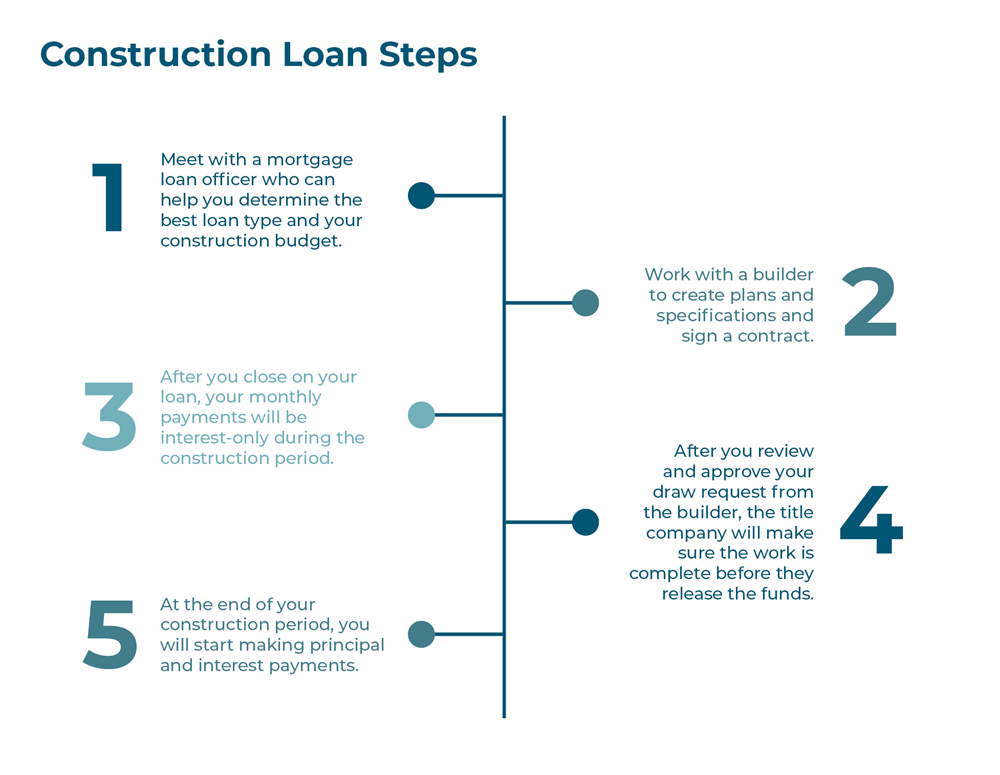

What are the steps in a construction loan?

Here is what you can expect at Landmark:

- Meet with a mortgage loan officer who can help you determine the best loan type and your construction budget.

- Work with a builder to create plans and specifications and sign a contract.

- After you close on your loan, your monthly payments will be interest-only during the construction period.

- After you review and approve your draw request from the builder, the title company will make sure the work is complete before they release the funds.

- At the end of your construction period, you will start making principal and interest payments.

Lot Loans

What is a lot loan?

A lot loan is financing to buy a plot of land. If you want to purchase land but aren’t ready to build a home on it yet, this could be a great option.

What is the benefit of a lot loan?

As the adage goes, “location, location, location.” Maybe you want to live by the lake or be in a certain neighborhood. If you find the perfect piece of land but you don’t intend to build until a few years down the road, a lot loan is a great way to secure that land.

What is the required down payment on a lot loan?

At Landmark, we require 20% down for a lot loan.

What are lot loan rates?

View our current lot loan rates.Need More Information?

Have a construction loan or lot loan question we didn’t answer? Let us know! Our mortgage loan officers are happy to give you more information about how construction loans work and discuss your unique needs and circumstances. Building your dream home starts by landing the perfect loan. Reach out to us or apply today.